International Payment Gateway List

Discover top-rated international payment gateway companies that help businesses accept payments worldwide with confidence and ease.

What Is a Payment Gateway?

A secure bridge between your business and the banks that process customer payments. A payment gateway enables your business to accept payments online by securely transferring payment details to the processor and acquiring banks. It helps protect sensitive data with encryption so you do not have to handle or store raw card information yourself.

Simple

Payment gateways help reduce fraud, ensure PCI compliance, and provide a seamless checkout experience. They are especially crucial for e-commerce businesses, SaaS platforms, and any merchant accepting online transactions.

Global Reach

A payment gateway enables merchants to accept payments from customers around the world. These providers typically support multi-currency processing, local payment methods, and compliance with cross-border regulations.

Lot of Options

Modern gateways offer flexible integration methods: hosted payment pages, APIs, SDKs, and plugins for major e-commerce platforms. Choose the option that best suits your technical needs and user experience goals.

Top Payment Gateways

Featured Payment Gateways

Leading payment gateways recommended by bilixe based on performance, global reach, and features.

New Payment Gateways

Recently Added on Bilixe

Do not miss out on the recently added payments gateway we have picked out just for you!

Full List

Explore The International Payment Gateway List

Browse our extensive list of international payment gateway companies to find the perfect fit for your business.

Designed for Everyone

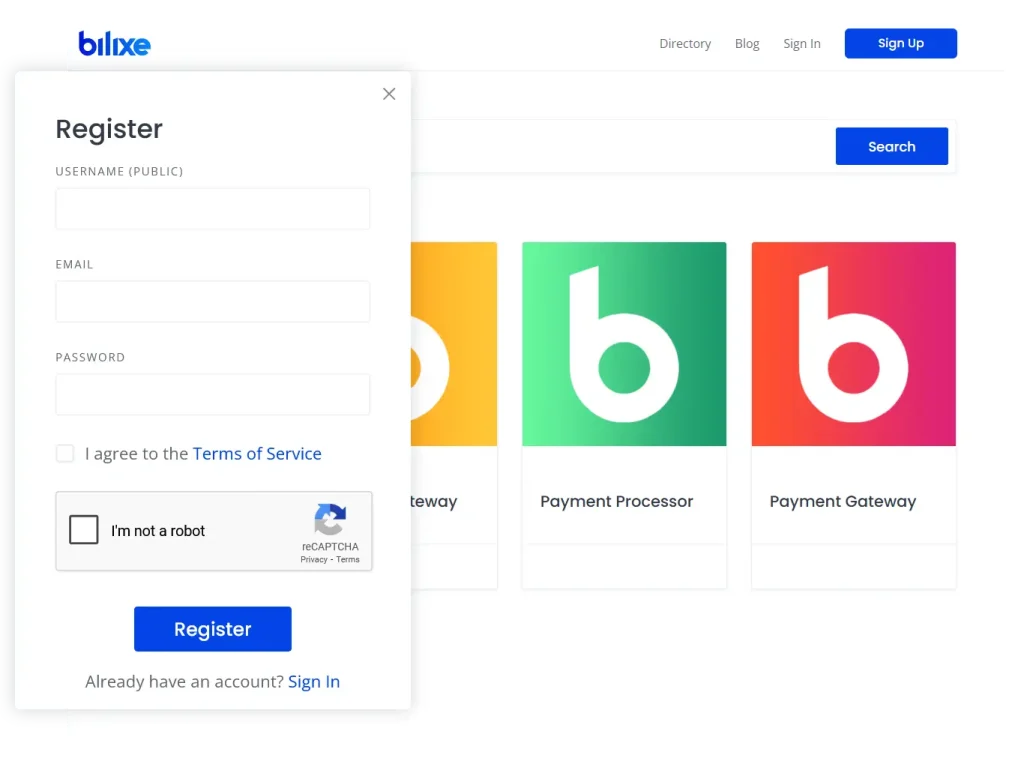

Unlock Full Access to the International Payment Gateway List

Whether you are a merchant or a payment service provider, creating a free account gives you full access to powerful features designed to help you connect and grow.

For Merchants

For Payment Service Providers

Clear Answers

Frequently Asked Questions

Answers to common questions about choosing and using providers from the international payment gateway list

Benefits of Using International Payment Gateways

Selecting the right provider from an international payment gateway list can bring significant advantages to businesses operating across borders. As consumer expectations rise and competition intensifies, offering a seamless and secure payment experience is no longer optional, it is essential.

One of the most immediate benefits of using an international gateway is multi-currency support. Businesses can display prices in local currencies, reducing cart abandonment and increasing trust. This feature is especially important for companies targeting diverse markets, as it creates a more familiar checkout experience for international customers.

Another key advantage is compliance with global security standards. Many providers on a list of payment gateway companies offer built-in tools that support PCI DSS compliance, data encryption, tokenization, and real-time fraud detection. These features protect both the merchant and the customer, building credibility and minimizing financial risk.

International gateways also simplify cross-border settlements and local acquiring, which can reduce transaction fees and speed up payouts. Some gateways work with regional acquirers to offer better rates and improve payment acceptance in specific territories.

Finally, scalability is a major benefit. By choosing a provider from a comprehensive payment gateway list, businesses gain access to flexible APIs, modular features, and integration options that grow with their needs, whether they are entering new markets or launching new products.

How to Choose the Right Payment Gateway for Your Business

With so many options available on an international payment gateway list, identifying the right provider can feel overwhelming. However, by focusing on a few essential criteria, businesses can narrow down their choices and select a gateway that aligns with their operational goals and customer needs.

| Supported Regions and Currencies | Begin by ensuring that the provider operates in your target countries and supports local currencies. Some providers specialize in specific regions, while others have truly global coverage. A mismatch here can lead to declined transactions or high foreign exchange fees. |

| Integration and Compatibility | Review the gateway’s integration options. RESTful APIs, SDKs for mobile apps, and hosted checkout pages are common offerings. Businesses should choose a gateway that integrates smoothly with their current tech stack and provides clear developer documentation. |

| Cost Structure | Compare transaction fees, chargeback fees, cross-border surcharges, and settlement costs. Not all providers on a payment gateway list are transparent about pricing, so reading the fine print or requesting a detailed quote is advisable. |

| Risk and Industry Fit | Some providers are better suited for high-risk industries or subscription-based models. Evaluate how well the gateway handles your business model and whether it offers tools like recurring billing, fraud screening, or chargeback management. |

Popular Use Cases for International Payment Gateways

The growing demand for cross-border commerce has led to a wide variety of use cases for international payment gateways. Whether serving consumers or businesses, merchants across different industries rely on solutions from the international payment gateway list to handle the complexity of global payments.

- eCommerce and Retail

- Subscription-Based Services

- Marketplaces and Aggregators

- B2B Cross-Border Payments

Online stores that sell physical or digital goods across borders need payment gateways that support multiple currencies, languages, and localized checkout experiences. These gateways also facilitate dynamic currency conversion and region-specific payment methods, which help boost conversion rates in international markets.

SaaS companies, streaming platforms, and digital content providers often require gateways that support recurring billing, tokenized card storage, and automated invoicing. Providers on the payment gateway list may offer tools for managing renewals, dunning processes, and failed payments, all critical for maintaining revenue continuity.

Multi-vendor platforms need features like split payments, escrow services, and vendor onboarding workflows. Many gateways on the list of payment gateway companies offer specialized marketplace APIs that streamline these operations while ensuring compliance with anti-money laundering (AML) and Know Your Customer (KYC) regulations.

International gateways are also used in B2B transactions for invoicing, payment tracking, and settlement across different banking systems. These use cases often benefit from batch processing, higher transaction limits, and support for local payment rails in multiple countries.

The Bilixe Advantage: Smarter Discovery of Payment Gateways

Finding the right provider from an international payment gateway list requires more than just browsing names, it demands a structured way to compare features, evaluate fit, and access up-to-date information. This is where specialized platforms can offer substantial value by organizing the vast and often fragmented list of payment gateway companies in one centralized place.

Rather than relying on manual research or scattered search results, businesses can benefit from tools that allow them to apply filters based on region, transaction fees, supported currencies, integration options, or compliance certifications. These filters help narrow down the payment gateway list to only those providers that meet specific business needs, saving time and reducing guesswork.

In addition, access to community-driven reviews, performance statistics, and transparent feature breakdowns makes it easier to evaluate providers not just on what they offer, but on how they perform in practice. Features like search alerts, saved favorites, and direct messaging also help streamline vendor selection and communication.

For businesses exploring payment options for international expansion, structured discovery platforms serve as a practical solution to assess the market, compare providers, and make more informed decisions, especially when navigating a crowded and competitive international payment gateway list.

How Payment Providers Can Join the Gateway List

With the rising demand for cross-border commerce and digital payments, being visible on an international payment gateway list is increasingly important for payment service providers. Appearing on such lists enhances discoverability, improves trust with merchants, and enables providers to differentiate themselves in a competitive market.

To be included in a payment gateway list, providers need to supply detailed and accurate information about their services. This may include supported regions, accepted currencies, transaction fees, integration methods (API, plugins, hosted checkout), regulatory certifications (such as PCI DSS or PSD2 compliance), and the types of merchants or industries they serve. The goal is to ensure that potential clients can compare providers meaningfully and make informed choices.

Bilixe curates a list of payment gateway companies and allows providers to claim or add their business profile directly. Doing so enables the provider to update service information, upload branding elements, and respond to user reviews. Participating in bilixe’s directories not only increases visibility but also helps build credibility through transparent engagement with the merchant community.