- United Kingdom Payment Gateway Market: Overview

- Payment Methods Trends in the UK: 2023 vs 2033 Forecast

- Payment Gateways in the UK: Key Players

- Ultimate List of Payment Gateways in the United Kingdom

- Search For The Best Payment Gateway in the UK Using Bilixe

- Conclusion

- FAQ: Payment Gateways in the United Kingdom

The UK payment gateway market is crucial for the country’s digital economy. It allows safe and smooth online transactions between merchants and consumers.

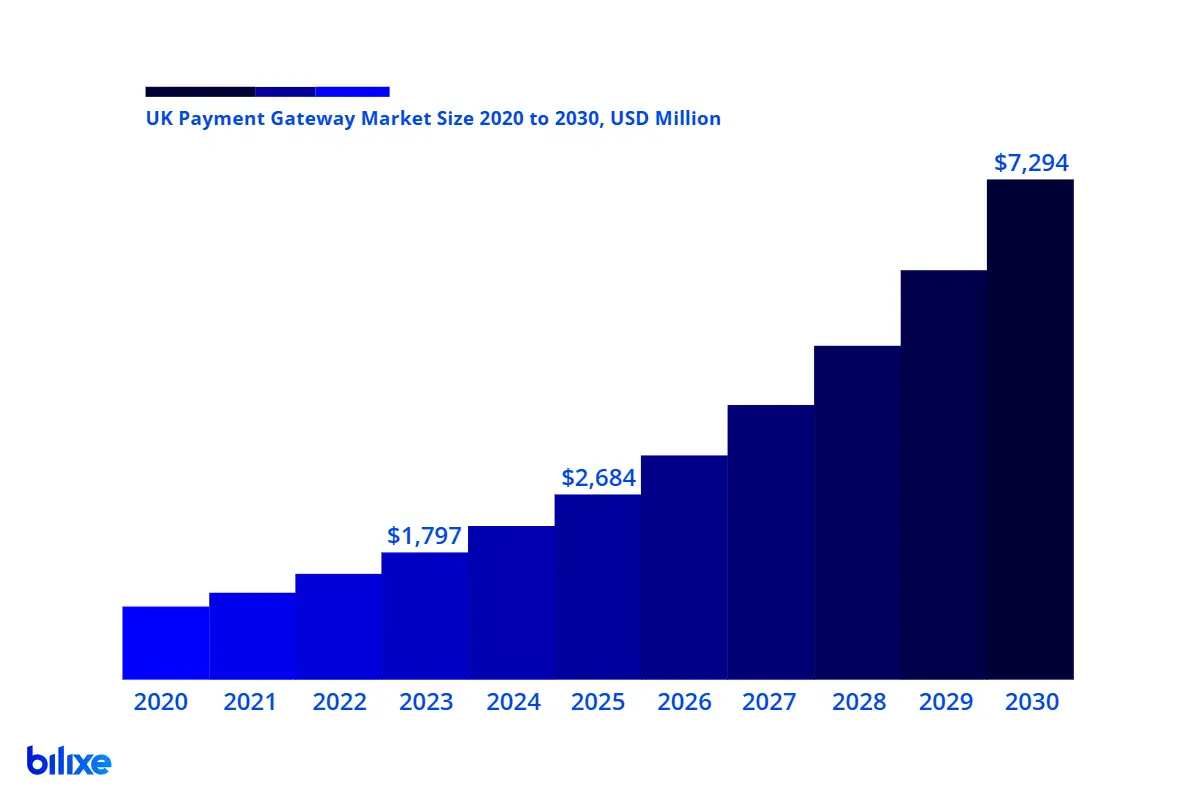

United Kingdom Payment Gateway Market: Overview

By 2030, the market is expected to be worth about $7,294 billion. This shows a strong compound annual growth rate (CAGR) of 22.2% from 2024 to 2030, based on projections from Grand View Research data.

This growth trajectory highlights the growing use of digital payments, driven by several key factors:

- E-commerce Surge: The UK leads the world in e-commerce, with online sales making up nearly 25% of total retail sales as of 2022, according to the Office for National Statistics.

- Mobile Payment Adoption: The widespread use of smartphones has boosted mobile payments. In 2023, 42% of UK adults signed up for mobile payment services like Apple Pay and Google Pay, up from 30% in 2022.

- Digital Wallet Popularity: Digital wallets, such as PayPal, Apple Pay, and Google Pay, made up 38% of e-commerce payments in 2023. This shows a shift from traditional card payments.

- Regulatory Support: The Open Banking initiative has encouraged innovation by allowing account-to-account (A2A) payments and increasing competition in the payment market.

The market is competitive, with established companies and new players competing for market share. The rise of alternative payment methods, like Buy Now, Pay Later (BNPL) and A2A payments, is changing what merchants and consumers want, creating chances for payment gateways to expand their services.

Payment Methods Trends in the UK: 2023 vs 2033 Forecast

According to UK Finance, the leading trade association for the UK’s banking and financial services sector, the forecasted total payment volumes (%) in the UK for 2033 compared to 2023 are as follows:

| Payment Method | 2023 | 2033 (forecasts) |

| Debit Card | 51% | 56% |

| Cash | 12,3% | 6% |

| Faster payment, including other remote banking | 10,2% | 13% |

| Direct Debit | 10% | 9% |

| Credit / charge / purchasing card | 9,5% | 10% |

| Bacs Direct Debit | 4,5% | 4% |

| Standing order | 1,3% | 1% |

| Other | 1% | 0,9% |

| Cheque | 0,2% | 0,1% |

Current data and forecasts for UK payment volumes show clear shifts in how consumers and businesses prefer to pay:

- Debit Cards Dominance: Debit cards continue to be the top choice for payments. They made up 51% of transactions in 2023 and are expected to increase to 56% by 2033. This trend highlights the ongoing growth of card-based transactions due to their convenience and acceptance.

- Decline in Cash Usage: Cash payments are likely to fall drastically, dropping from 12.3% in 2023 to 6% by 2033. This trend indicates a major shift toward digital and contactless options that offer convenience and match changing consumer habits.

- Rise in Faster Payments: Faster payment services, including remote banking, are expected to rise from 10.2% in 2023 to 13% by 2033. This growth meets the increasing demand from businesses and consumers for quick and smooth transactions.

- Stable Trends for Credit and Direct Debit: Credit, charge, and purchasing cards will see slight growth from 9.5% to 10%. Traditional Direct Debit and Bacs Direct Debit methods remain consistent, with minor declines. This suggests steady preferences within certain demographics.

Overall, UK businesses should focus on flexible payment gateways that support the growing number of digital payment methods, helping them meet changing consumer expectations.

Payment Gateways in the UK: Key Players

The UK payment gateway market includes a combination of established leaders and rapidly growing challengers. The table below summarizes the top vendors, their market positions, and estimated market shares based on historical data, website usage statistics, and industry insights:

| Vendor | Market Position | Niche/Scale/Innovation | Key Strengths | Estimated Market Share |

| Worldpay | Likely Market Leader | Large-Scale Enterprise | Comprehensive solutions for online and offline payments, strong UK presence | ~30% (estimated) |

| Stripe | Strong Challenger | Innovation-Driven | Developer-friendly APIs, scalable for startups to enterprises | ~25% (estimated) |

| PayPal | Major Player | Consumer Trust & SME Focus | Wide acceptance, digital wallet integration, BNPL options | ~25% (estimated) |

| Adyen | Niche Leader | Global Enterprise | Unified platform for global payments, multi-currency support | ~10% (estimated) |

Related reading: “Top 30+ Payment Gateways in India: The Ultimate List for Businesses”.

Ultimate List of Payment Gateways in the United Kingdom

Below is a list of the best payment gateways in the UK. This complete list includes global providers and UK-based payment providers, along with important details to help you compare your choices.

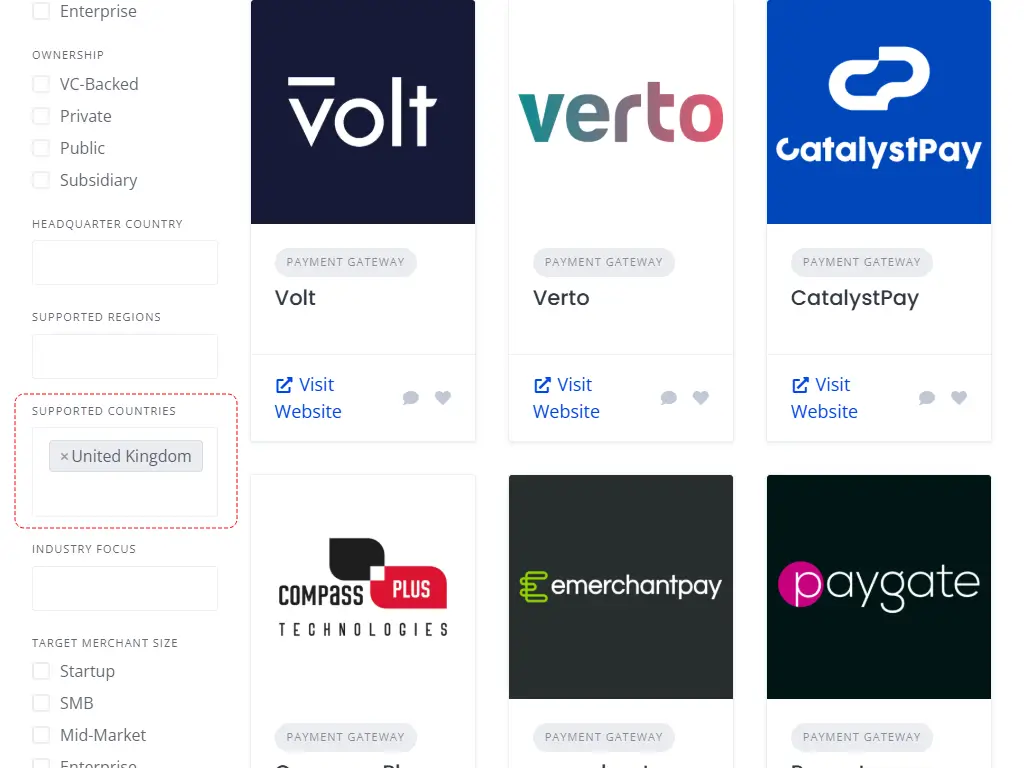

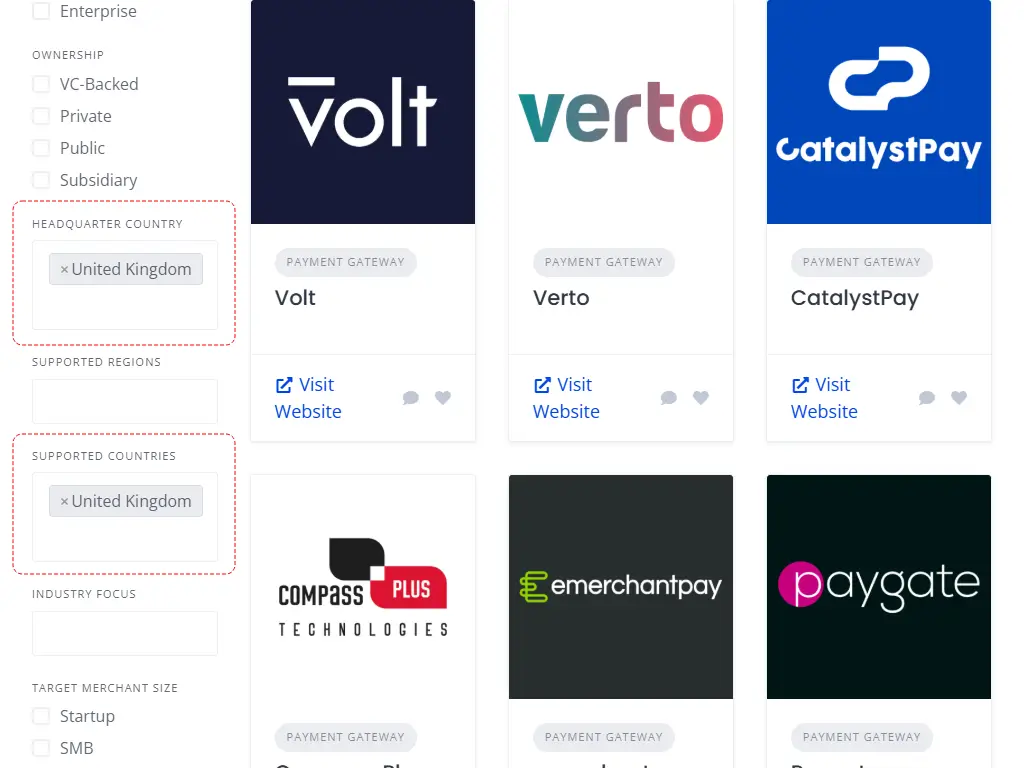

Search For The Best Payment Gateway in the UK Using Bilixe

To make your research easier, we offer an interactive list of payment gateways in the UK, both online and in-person. This directory allows you to filter and compare a variety of payment service providers based on your needs. You can sort providers by features, supported payment methods, fees, and more.

Related reading: “Canada Payment Gateway Guide: Top Picks”.

International Payment Gateways in the UK

To find providers suitable for your needs, simply set the “Supported Countries” filter to “United Kingdom”.

Local Payment Gateways in the UK

To find domestic (UK-based) gateways suitable for your needs, simply set the “Headquarter Country” filter to “United Kingdom” as well as the “Supported Countries” filter to “United Kingdom”.

Conclusion

The UK payment gateway market is set for strong growth, fueled by e-commerce, mobile payments, and new technology. Worldpay, Stripe, and PayPal dominate the market, but competition is increasing from Adyen and new entrants.

FAQ: Payment Gateways in the United Kingdom

Recommended Articles

International Payment Gateway List

What Is a Payment Gateway? A secure bridge between your business and the banks that…

Popular Payment Methods in Asia: Country-by-Country Guide

Understanding payment methods by country helps merchants localize checkout, reduce friction, and improve approval rates….

Guide to SoftPOS: Turn Any Phone into a Payment Terminal

For decades, accepting card payments meant dealing with expensive hardware terminals. Merchants relied on bulky…

Find the Best Payment Service Provider for Your Business