- The Digital Payment Boom in India

- Local Payment Gateways in India

- List of Local Payment Gateways in India

- International Payment Gateways in India

- List of International Payment Gateways in India

- Local Payment Gateways in India vs International Payment Gateways in India

- How to Choose the Best Payment Gateway in India

- Conclusion

- FAQ: Payment Gateways in India

India’s digital payments ecosystem is thriving. It changes how merchants and consumers handle transactions online. India saw over 208.5 billion digital payment transactions in 2024, demonstrating a fast move toward cashless methods. With this growth, businesses are more focused on finding the best payment gateway in India to process customer payments securely and efficiently.

In this guide, we will examine the payment gateway landscape in India, discuss the top providers, and explain how to choose the best payment gateway in India.

The Digital Payment Boom in India

The rise of e-commerce, mobile wallets, and real-time payment platforms has made India one of the leaders in digital transactions. Government initiatives like Digital India and UPI (Unified Payments Interface) have sped up the move towards a cashless economy. In fact, UPI accounted for about 83% of India’s total digital payment volume in 2024. This shows how quickly Indians have accepted instant payments through smartphones.

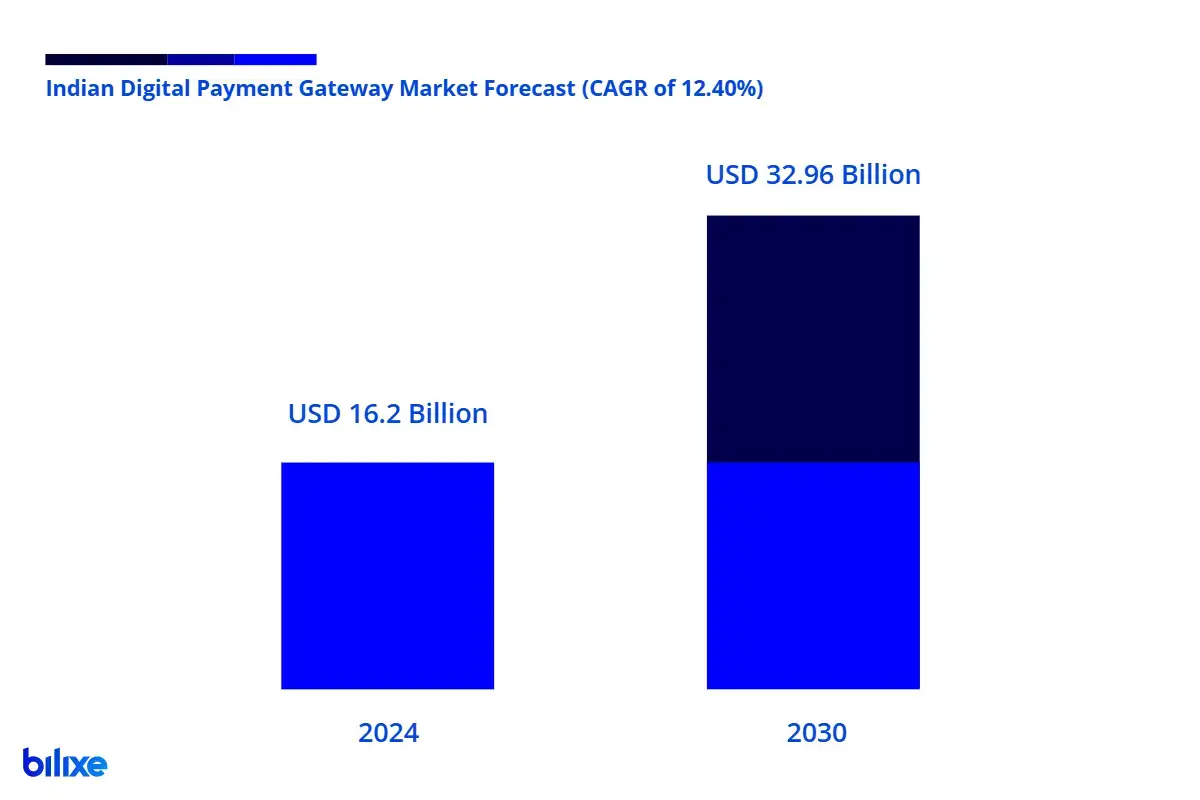

This booming market has attracted many fintech companies and banks that offer payment gateway services. The Indian payment gateway market was valued at around USD 16.2 billion in 2024, and it is expected to reach about USD 33 billion by 2030, growing roughly 12% each year.

Related reading: “Payment Gateway API Explained: How It Works”.

Local Payment Gateways in India

As digital payments increase, several domestic payment gateway companies have emerged in India. Local providers like Paytm, Razorpay, PayU, CCAvenue, Instamojo, and Cashfree serve millions of merchants with solutions tailored to local preferences. These platforms usually support a wide range of payment methods, including credit and debit cards, net banking, mobile wallets, online UPI payments, and even EMIs or “Buy Now, Pay Later” options. They also often offer features like easy plugins for e-commerce platforms and useful dashboards for transaction tracking.

Recently, India’s central bank, the Reserve Bank of India (RBI), has tightened regulations to ensure only trustworthy and secure providers operate in this field. RBI now requires payment aggregators (providers that help online merchants accept payments) to be licensed. Top gateways obtained their official Payment Aggregator licenses from RBI. This regulatory oversight is beneficial for merchants because it ensures that major payment gateways in India meet strict security, data protection, and capital requirements.

Local Acquiring

List of Local Payment Gateways in India

International Payment Gateways in India

Besides domestic players, international payment gateway providers are also entering the Indian market. Global companies like Stripe and PayPal offer services in India or partner with local banks, allowing Indian businesses to accept payments from customers worldwide. The entry of international payment gateways in India brings global best practices and technology, giving merchants more options.

However, international payments often come with extra compliance steps and costs. Gateways may require additional documentation to follow foreign exchange rules and usually charge higher transaction fees for payments in USD, EUR, or for cards issued outside India. Merchants should compare these fees and check if the gateway supports popular international payment methods, like American Express cards or PayPal payments, needed for their target customers.

International Acquiring

List of International Payment Gateways in India

Local Payment Gateways in India vs International Payment Gateways in India

| Feature | Domestic Payment Gateways in India | International Payment Gateways in India |

| Primary Audience | Indian startups, SMEs, D2C brands, local marketplaces | Global merchants, SaaS providers, cross-border businesses |

| Currency Support | Primarily INR. Limited support for foreign currencies | Multi-currency (USD, EUR, GBP, etc.) with currency conversion |

| Payment Methods Supported | UPI, RuPay, NetBanking, wallets (Paytm, PhonePe), EMI, cards | Credit/debit cards (Visa, Mastercard), PayPal, Apple Pay, etc. |

| Regulatory Compliance in India | Fully compliant with Indian regulations (RBI, PCI-DSS, etc.) | May have limitations with RBI compliance, data localization |

| Setup Complexity | Streamlined for Indian entities. Faster onboarding | Requires additional documentation, longer KYC process |

| Settlement Time | Usually T+1 to T+3 business days | Often 3–7 days. Can vary by currency and region |

| Fraud & Risk Tools | Varies by provider. Typically sufficient for local use | Advanced tools with global anti-fraud systems |

| Best Use Case | Domestic e-commerce, local education platforms | Cross-border commerce, SaaS platforms, export services |

How to Choose the Best Payment Gateway in India

Choosing the best payment gateway for your business in India can be overwhelming due to the many options available. Instead of looking for a one-size-fits-all solution, assess gateways based on key factors that are important for your operations. Here are the essential factors to consider when comparing payment gateways in India:

Supported Payment Methods

Make sure the gateway accepts all of the payment types preferred by your customers. A good Indian payment gateway will at least support domestic and international credit and debit cards, large net banking providers, and UPI payments. Mobile wallet, EMI payment, pay-later options are also the features that might be useful depending on your customer base. The more payment options, the easier for customers to pay.

Fees and Pricing

One of the top considerations is the cost of transaction, this is particularly important for small businesses who want the most affordable payment gateway India. Many providers apply a Merchant Discount Rate (MDR), a percentage fee for every transaction, which can be different depending on the payment method. For instance, UPI and RuPay debit card transactions have zero MDR as per government rules and so the providers cannot charge fees on these. But other options, such as credit cards, may come with fees of roughly 2% or more for each transaction.

Integration and Ease of Use

Gateway should smoothly integrate with your website or application. If you are using effective e-commerce platforms, look for suppliers that offer plugins or SDKs, or integration for reliable API and documentation customization. Rapid boarding is another advantage, as some gateways provide immediate activation for basic accounts, while others take days or weeks for full use. A user-friendly dashboard to track transactions and a simple flow of buying coins for customers will increase the general experience.

Security and Compliance

Trust is essential in payments. Your chosen gateway must support two-factor authentication like OTP verification for card payments and adhere to PCI-DSS compliance mandatory in India. Sophisticated tools for detecting fraudulent activity provide a considerable edge. Top gateways employ sophisticated AI and machine learning algorithms pretty quickly spotting suspicious transactions almost instantly in real time nowadays. Confirm if the provider adheres strictly to RBI guidelines involving practices like card tokenization and conducting security audits fairly regularly. A secure gateway shields you and customers from fraudulent activities thereby enhancing reputation as a safe haven for transacting business online.

Advanced Features

Consider unique features that could potentially benefit your business model greatly over time somehow. If you operate a subscription-based service you’ll need an ability quite badly to handle payments that recur regularly over time. Operating a marketplace might necessitate split payments dividing customer funds amongst multiple vendors automatically. Some gateways also provide additional services like payment links for easy invoicing or analytics dashboards that offer insights into customer purchasing behavior. These extras can differentiate a good gateway from one that fits your needs perfectly.

Related reading: “How to Compare Online Payment Providers”.

Conclusion

India’s digital economy provides many options for payment gateways and processors. You can find flexible domestic platforms and international payment gateways that connect Indian businesses to the world. These choices help merchants accept payments in almost any form. The key is to choose carefully. Think about your customers’ preferences, transaction volumes, and which features are necessary for your operations. This way, you can narrow down the options to find the gateway that fits your needs. Remember, the aim is not to find the best payment gateway in India overall but the best one for your business.

FAQ: Payment Gateways in India

Recommended Articles

High Risk Payment Gateway vs. Standard Gateway: Comparison Guide

Merchants exploring payment solutions often ask: Do I need a high risk payment gateway or…

Best Credit Card Processing for Small Business [Guide]

According to the Federal Reserve survey, about 80% of small businesses face payment-related challenges. That…

Payment Gateway API Explained: How It Works

Digital payments have become a backbone of today’s economy – in 2024 the global volume…

Find the Best Payment Service Provider for Your Business