Disclaimer

Please note that the payment industry does not have unified terminology. The same word can have slightly different meanings depending on the provider, platform, or region. The definitions in this glossary reflect how bilixe uses and interprets these terms based on our experience in the industry. They are intended to provide helpful context, not legal or regulatory definitions.

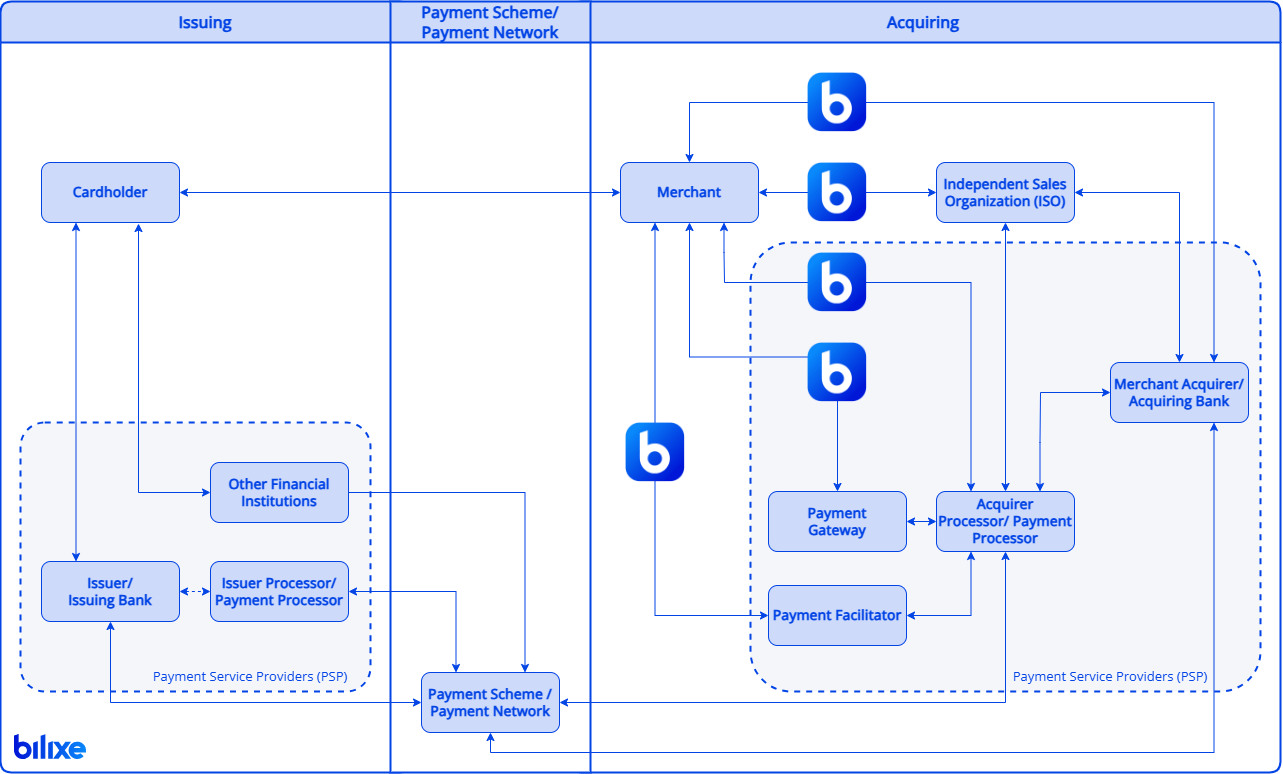

Role Map

Key Roles in the Payment Industry

Understand how payments flow and the key participants involved, including issuers, acquirers, processors, and PSPs. This diagram also illustrates where bilixe fits in and how it assists businesses in finding the best payment service providers.

Clear Definitions

Key Terms in the Payment Industry

Explore payment terms glossary with clear, business-friendly definitions. Understand industry jargon and choose the right payment service provider.

What is a cardholder?

A cardholder is the person to whom a payment card (debit, credit, or prepaid) is issued. The cardholder uses the card to make payments or withdraw funds from their bank account.

What is a merchant account?

A merchant account is a type of business bank account that allows a merchant to receive payments from cardholders. It is issued by an merchant acquirer (acquiring bank) and comes with a merchant identification number (MID) used to track transactions.

What is a merchant acquirer? What is an acquiring bank?

A merchant acquirer, or acquiring bank, is the bank that “acquires” card payments from issuing banks for depositing in a merchant account. It communicates with the issuing bank through payment networks (payment schemes) and ensures the transaction is completed, then transfers the funds to the merchant.

What is a merchant ID (MID)?

A merchant ID (MID) is the unique number associated with a merchant account.

What is a merchant?

A merchant is any individual or business that sells products or services and accepts electronic payments, such as credit cards, debit cards, digital wallets, or crypto payments.

What is a payment facilitator (PayFac)?

A payment facilitator (PayFac) is a payment service provider (PSP) that gathers multiple merchants (called sub-merchants) under one merchant ID (MID) and sometimes also acts as a payment processor (acquirer processor).

What is a payment gateway?

A payment gateway is the front‑end technology that captures and securely transmits customer payment details (like card data or digital wallet info) from the checkout page to the payment processor (acquirer processor) or merchant acquirer (acquiring bank). It may also perform fraud checks, such as 3D Secure authentication.

For more information, you can read our article ‘Payment Gateway vs Payment Processor: What’s the Difference?‘.

What is a payment scheme? What is a payment network?

A payment scheme, also known as a payment network, is the infrastructure that connects cardholders, issuing banks, merchant acquirers (acquiring banks), and merchants. Examples include Visa, Mastercard, UnionPay, and American Express. These networks govern the rules and handle the actual transfer of payment data between parties.

What is a payment service provider (PSP)?

A payment service provider (PSP) is a company that offers a complete package of services for merchants to accept payments. This may include a payment gateway, processing, fraud protection, reporting tools, and sometimes even acquiring services.

At bilixe, we use the term payment service provider (PSP) broadly to describe any actor involved in enabling payments, including payment gateways, payment processors (acquirer processors), merchant acquirers (acquiring banks), and PayFacs.

What is an acquirer processor? What is a payment processor?

An acquirer processor, also known as a payment processor or frontend processor, is the technology provider that supports the merchant acquirer (acquiring bank). It securely routes card transactions, communicates with the payment networks (payment schemes) (like Visa or Mastercard), and ensures the payment is approved or declined.

What is an acquirer?

An acquirer is an merchant acquirer (acquiring bank) or an payment processor (acquirer processor) or both that enables merchants to accept payments.

What is an Independent Sales Organization (ISO)?

An Independent Sales Organization (ISO) is a third-party company authorized to sell payment processing services on behalf of payment service providers (PSPs). ISOs often help merchants set up payment solutions by partnering with payment gateways, payment processors (acquirer processors), and merchant acquirers (acquiring banks).

What is an issuer processor?

An issuer processor, also known as a payment processor or backend processor, is the technology provider that supports the issuing bank in the processing transactions. It ensures the cardholder has sufficient funds and approves or declines transactions.

What is an issuer?

An issuer is any bank or licensed financial institution that issues payment cards to cardholders. Non-banks can also become issuers through partnerships with licensed card sponsors, known as BIN sponsors.

What is an issuing bank?

An issuing bank is the bank that provides a payment card (credit or debit) to a cardholder. It verifies the cardholder’s identity, approves or declines transactions, and sends funds to the merchant acquirer (acquiring bank) when a purchase is made.