Canada Payment Gateway Guide: Top Picks for 2025

Payment gateways are the foundation of safe and effective payment processing. Acting as a middleman,…

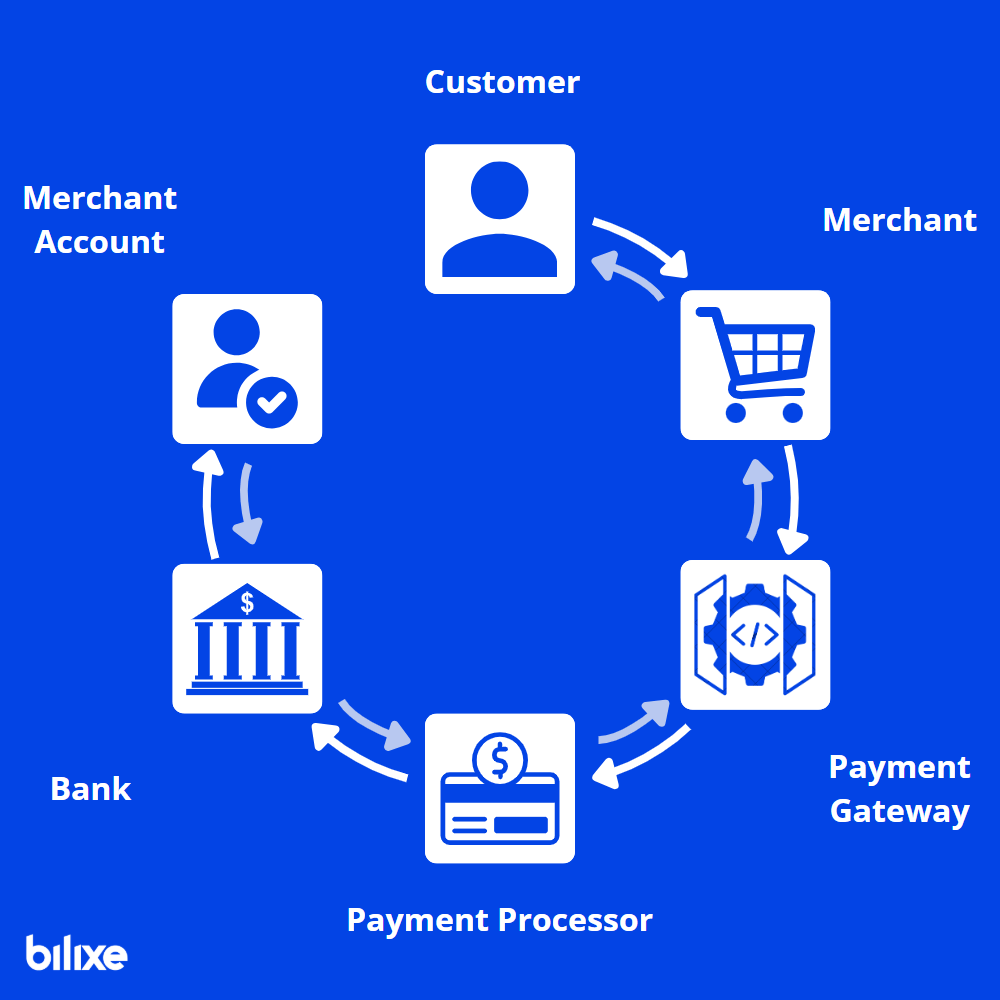

A payment gateway is a technology that enables merchants to accept debit or credit card purchases from customers online or in-store. Acting as a secure bridge between the customer, the merchant, and the payment processor, the payment gateway plays a critical role in the authorization and encryption of payment information.

When a customer initiates a transaction, whether by entering their card details at an online checkout or tapping a card at a point-of-sale terminal, the payment gateway is responsible for capturing that data and securely transmitting it to the appropriate payment processor. This communication happens within seconds and is essential for confirming whether the payment is approved or declined.

At its core, the gateway encrypts sensitive cardholder data, ensures it is transmitted through a secure channel, and returns the response from the payment processor to the merchant. Without a payment gateway, businesses would have no way to accept card-not-present transactions safely.

In simple terms, a payment gateway is the front-end technology that interfaces with the customer. It gathers payment information, performs initial fraud checks, and forwards encrypted data to the processor for further handling. Many gateways also support features like multi-currency conversion, 3D Secure authentication, and recurring billing setups.

To better understand how gateways work in practice, consider a few well-known examples:

These providers demonstrate that while all gateways share a core function, their capabilities and integration models can vary widely depending on the needs of the business. You can find more examples by visiting our dedicated page featuring the international payment gateway list.

Understanding the role of a payment gateway is the first step in unraveling the broader comparison of payment gateway vs payment processor, which we’ll explore in the next section.

A payment processor is the financial engine that handles the movement of money between the buyer’s and the seller’s banks during a transaction. While a payment gateway manages the front-end communication between the customer and the merchant, the processor takes care of the behind-the-scenes work that ensures the transaction is authorized and settled correctly.

When a customer submits their payment details, the payment processor is responsible for communicating with the card networks and the issuing bank to determine if the transaction should be approved. If the transaction is validated, the processor then initiates the transfer of funds from the customer’s account to the merchant’s account. This entire process takes place in a matter of seconds but involves a complex series of steps designed to ensure accuracy and security.

The payment processor connects merchants, acquiring banks, issuing banks, and card networks such as Visa or Mastercard. It plays a central role in verifying that the customer has sufficient funds, managing authorization requests, and eventually facilitating the settlement of funds into the merchant’s account. In addition to processing transactions, many processors also provide services related to fraud prevention, chargeback handling, and reporting

Unlike a payment gateway, which is more customer-facing, the processor works behind the scenes. However, both are essential for completing online and in-store transactions securely and efficiently.

Understanding this role becomes clearer when looking at real examples:

Each of these providers helps move money from the customer to the business in a way that is fast, reliable, and compliant with financial regulations. Recognizing the distinct role of a processor is essential for understanding the broader discussion around payment gateway vs payment processor.

Understanding the difference between a payment gateway vs payment processor is essential for any business that accepts card payments. While these two components work closely together to complete a transaction, they serve different purposes within the payment ecosystem. Knowing how they differ can help merchants make better decisions about which services to choose and how to integrate them into their operations.

The payment gateway is responsible for collecting payment data from the customer and securely transmitting it for authorization. It handles the user interface at checkout, encrypts sensitive card information, and ensures it is passed safely to the next step. In contrast, the payment processor takes over once the data reaches the back end. It communicates with the card networks and banks to verify and execute the transfer of funds.

Simply put, the gateway handles the input and validation while the processor completes the financial transaction.

Both gateways and processors contribute to transaction security, but in different ways. Gateways focus on encrypting cardholder data and enabling authentication tools like 3D Secure. They are typically responsible for maintaining PCI DSS compliance on the front end. On the other hand, processors manage fraud detection systems, risk scoring, and chargeback handling, all of which are critical for maintaining trust and compliance behind the scenes.

The payment gateway influences the user experience by determining how the payment form looks and functions. It often supports features such as recurring billing, multi-language checkouts, and localized currency options. The processor, while invisible to the end user, impacts the speed and reliability of the transaction. Delays or failures at the processing stage can result in abandoned carts or customer frustration.

There can also be a cost difference between a payment gateway and a payment processor. Some providers charge separate fees for gateway services and transaction processing, while others offer bundled pricing. Understanding these costs can help businesses choose the right setup based on transaction volume, business size, and technical needs.

By examining these key differences, it becomes clear that both the payment gateway and the payment processor play vital but distinct roles in facilitating secure and efficient online transactions.

One of the most common questions for businesses exploring online payments is whether they need both a payment gateway and a payment processor. The short answer is that in most cases, yes, both components are required for completing card transactions. However, the way these services are delivered can vary depending on the provider and the business model.

Traditionally, businesses worked with separate providers for the gateway and the processor. The payment gateway handled customer-facing tasks such as capturing card details and verifying input. The payment processor managed back-end operations including communicating with banks, routing transactions through card networks, and finalizing the settlement of funds.

This separation offered flexibility in choosing best-in-class providers for each function. For example, a business might select a feature-rich gateway known for its checkout customization, while partnering with a low-cost processor to handle transactions. However, working with multiple vendors can also increase complexity, especially when it comes to integration, support, and compliance management.

Many modern providers offer combined services that function as both a payment gateway and a payment processor. These platforms allow merchants to set up payments with a single integration and unified dashboard. Examples include solutions that bundle front-end and back-end payment tools under one account.

Choosing an all-in-one solution can simplify setup and reduce friction, especially for small to mid-sized businesses. These providers often include built-in security, automatic compliance features, and consolidated pricing. However, the tradeoff may be reduced flexibility or vendor lock-in compared to using separate providers.

Whether to use a combined provider or separate services ultimately depends on your business goals, technical resources, and the markets you serve. Businesses operating in multiple countries or with complex needs may benefit from the freedom to mix and match services, while others may prioritize ease of use and quick deployment.

Understanding the difference between a payment gateway and a payment processor helps you make an informed decision about the structure that best supports your payments strategy.

Understanding the difference between a payment gateway and a payment processor becomes clearer when applied to real-world scenarios. While both systems are essential for accepting online payments, their roles and impact vary depending on the business model and the complexity of the transaction. The following examples illustrate how these two components work together in different business environments.

Consider an online retailer selling physical goods through a website. When a customer completes a purchase, the payment gateway captures the customer’s card details through a secure checkout form. It performs encryption and initial fraud checks before passing the data to the payment processor.

The processor then communicates with the card networks and issuing bank to authorize the transaction. If approved, it initiates the transfer of funds from the customer’s bank to the merchant’s acquiring bank. The gateway then displays a confirmation message to the customer. In this case, the gateway manages the interface and data security, while the processor handles the back-end money movement.

Now imagine a software company offering monthly subscriptions. The payment gateway handles recurring billing features by storing tokenized card data and automatically triggering charges each billing cycle. It also manages failed payment retries and expiration tracking.

The payment processor, in turn, processes each recurring transaction by routing the request through card networks and confirming with the issuing bank that the customer has sufficient funds. It handles disputes, chargebacks, and transfers funds to the merchant’s account on schedule.

In both examples, the gateway and processor must function in sync, but their responsibilities are distinct. The payment gateway focuses on secure communication and user experience, while the payment processor is tasked with validating transactions and transferring funds. These examples highlight why businesses need to consider both elements when choosing a payment solution.

Selecting the right payment infrastructure is a critical decision for any business that accepts digital payments. Whether you are a startup launching an e-commerce store or an established company expanding into new markets, understanding how to choose between a payment gateway and a payment processor or opting for an all-in-one provider is essential.

The first step is evaluating your business needs. Companies with limited technical resources may benefit from a fully integrated solution that combines both gateway and processing services. These setups often simplify onboarding, reduce development time, and offer a centralized dashboard for managing transactions. On the other hand, businesses with more complex requirements may choose to separate the gateway and processor to gain greater control, customize their checkout experience, or reduce costs by negotiating independently with each provider.

When comparing options, several factors should guide your decision:

A small online retailer may opt for an all-in-one solution to streamline operations and reduce setup time. In contrast, a high-volume marketplace may prefer to separate gateway and processing functions to maximize flexibility and performance.

The right configuration depends on your specific needs, transaction volumes, customer expectations, and technical capabilities. By carefully weighing these factors, businesses can avoid common pitfalls and build a payment infrastructure that is both efficient and adaptable.

Once you understand the difference between a payment gateway and a payment processor, the next step is identifying which providers are best suited to your specific business needs. That is where a structured and searchable directory becomes an essential tool.

Bilixe offers a comprehensive and organized list of payment providers, allowing merchants to explore their options with clarity and confidence. The platform is divided into five main categories:

By filtering providers based on type, merchants can immediately narrow their focus.

In addition to the category filter, bilixe provides a range of smart filters that help refine search results even further. These features allow businesses to find providers that match both technical requirements and operational goals without having to manually sort through hundreds of options.

Having quick access to categorized and filterable listings ensures that merchants can move beyond generic comparisons and focus on solutions that truly align with their payment strategy.

The terms payment gateway and payment processor are often used interchangeably, but they serve distinct roles within the payment ecosystem. The payment gateway acts as the secure front-end interface that collects and encrypts customer data during a transaction. The payment processor, on the other hand, works in the background to authorize payments and move funds between banks.

Understanding the difference between a payment gateway and a payment processor is essential for businesses looking to build a reliable and secure payment setup. Each component has a specific function, and together they ensure that transactions are processed smoothly from start to finish.

Whether your business needs both services from separate providers or chooses a unified solution, the key is selecting a structure that matches your operational goals, technical capabilities, and growth plans. There is no one-size-fits-all approach, but by learning how these systems work and evaluating real-world use

Taking the time to explore your options will help you design a payment infrastructure that supports your business not only today but also in the future as your needs evolve.

Recommended Articles

Payment gateways are the foundation of safe and effective payment processing. Acting as a middleman,…

Every business needs access to easy and efficient payment solutions. But not every company can…

Australia’s digital payments market is changing quickly. It’s important for merchants to know about local…

Find the Best Payment Service Provider for Your Business