Best Payment Gateways In Indonesia: Top Picks Compared

Indonesia has one of the most dynamic payment markets in Asia, but it does not…

The checkout page is the key moment for any online business. It is the point where a visitor either becomes a customer or leaves their cart behind. For merchants, building the checkout experience comes with a tough choice: Control vs. Liability.

Should you focus on the easiest way to secure transactions by using your provider? Or do you want to be in full control of the customer experience by building it on your own?

This guide explores the two main methods for connecting to a payment gateway: Hosted Payment Pages and API Integration. It will help you decide which approach suits your business stage, budget, and risk tolerance.

A Hosted Payment Page is a checkout form that is stored on your Payment Service Provider’s (PSP) server instead of your website.

Pros:

Cons:

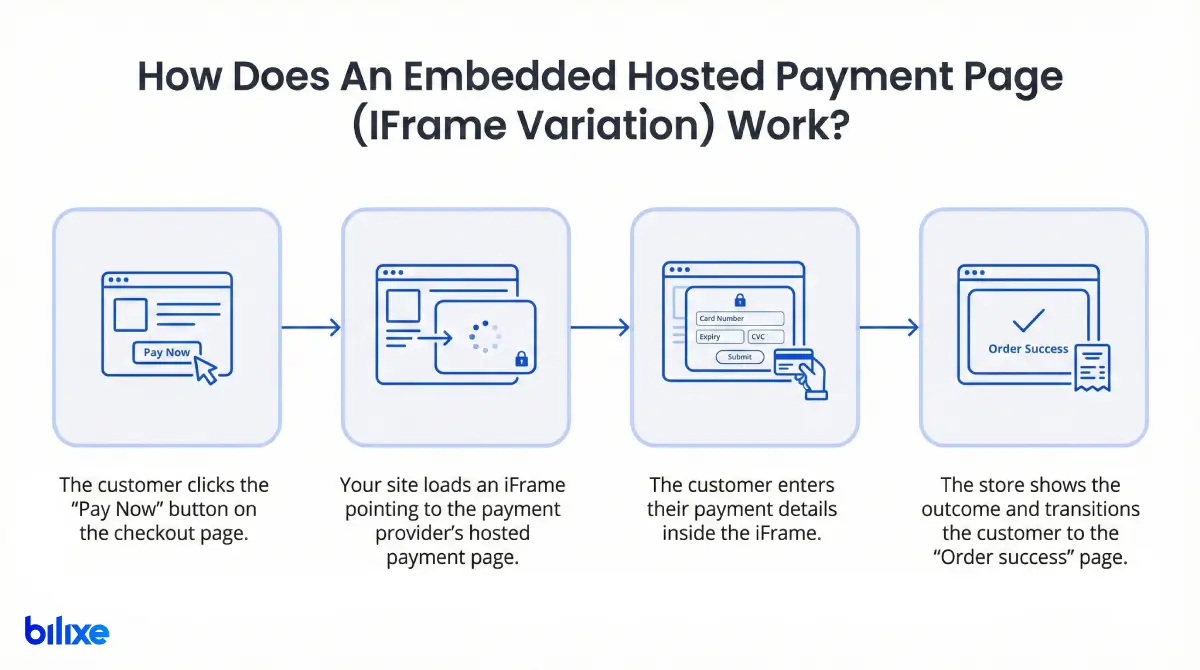

Some providers offer a mixed solution using an iFrame. This shows the hosted payment page within a window on your website. To the customer, it appears as if they are staying on your site, but the data is still entered into the PSP’s form.

API (Application Programming Interface) Integration, often referred to as “Direct Integration”, allows your website’s server to communicate directly with the payment gateway’s server.

In this case, the customer never leaves your website. You create the payment form yourself using HTML/CSS, giving you full control over the look and flow of the checkout. The payment data is sent via API calls in the background.

Because handling raw credit card data is risky, modern gateways like Stripe or Adyen offer “UI Components” or “Elements”. These are secure input fields that you can add to your custom form. They provide the appearance of API integration but handle data encryption securely like a hosted page.

Pros:

Cons:

Experts at bilixe highlight that “manual maintenance” of APIs is not only about fixing bugs, it involves keeping up with regulations.

“When the EU introduced SCA (Strong Customer Authentication), merchants using Hosted Pages had their updates managed by the PSP automatically. Those with direct API integrations had to manually adjust their checkout processes to support 3D Secure 2.0, or they risked high transaction failure rates,” says Andrii K, CEO of bilixe.

This often influences small to mid-sized businesses. Every merchant accepting cards must comply with the Payment Card Industry Data Security Standard (PCI DSS). However, how you integrate determines how hard that compliance is.

When you use a Hosted Payment Page, you never handle, process, or store raw card data. It goes directly to the PSP.

Note: Starting March 31, 2025, for embedded payment forms (iFrames), SAQ A requires merchants to confirm their page is secure against script attacks or to ensure the TPSP solution protects against them.

If you create a direct API integration and your server handles the card data before sending it to the gateway, your compliance responsibilities increase.

Note: Using “UI Components/Tokenization” can lower this burden back to SAQ A-EP, but it is still more complex than a Hosted Page.

Marketing teams typically prefer API integrations, while IT teams often lean toward Hosted Pages. And here is why.

With a Hosted Page, the URL change can be unsettling. If a customer is shopping at cool-sneakers.com and suddenly sees payment-processor-global.net for entering their credit card, they may hesitate and abandon the cart.

Stat to know:

API integrations allow for payments to appear “invisible”. You can add features such as:

Stat to know:

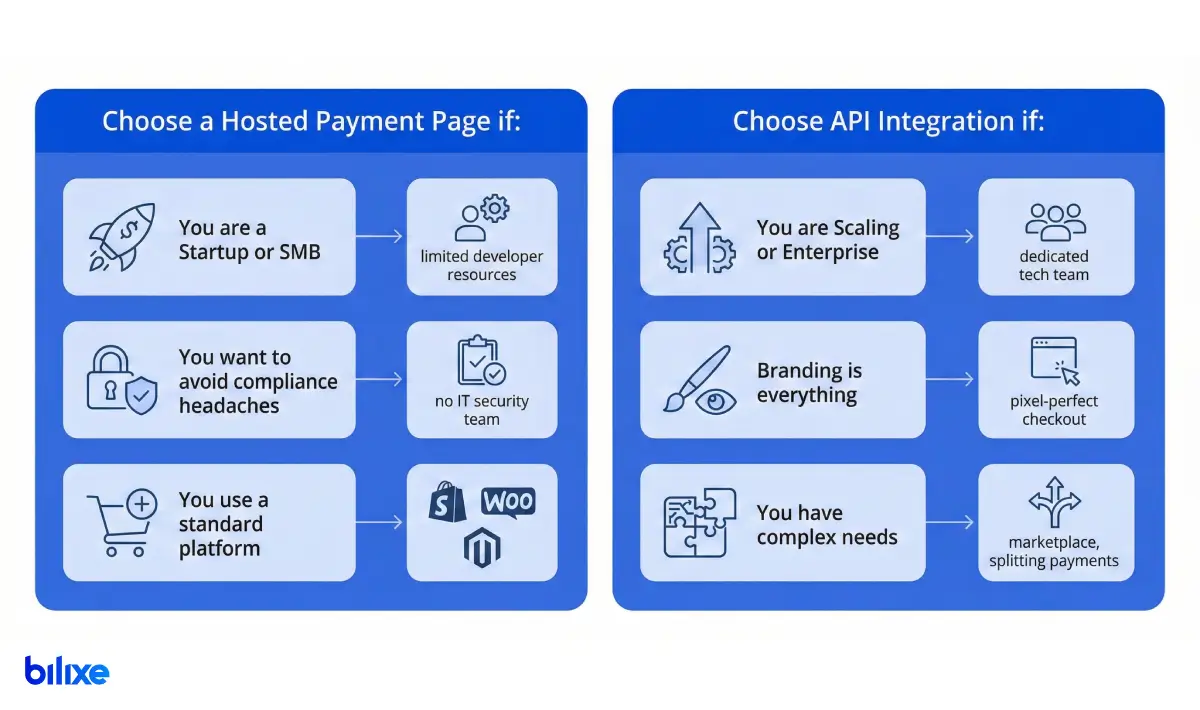

There is no “best” method, It is all about what fits your current resources.

Choose a Hosted Payment Page if:

Choose API Integration if:

Your payment integration strategy is not set in stone. Many successful businesses start with a Hosted Payment Page to test their market, then switch to an API Integration when they have the revenue to support a development team.

Still deciding? Do not guess. Use bilixe, a directory of payment providers, to find payment services based on “Developer & Integration” options. Whether you need a basic hosted payment page or a more robust developer-first API, you can compare the top providers side-by-side.

Recommended Articles

Indonesia has one of the most dynamic payment markets in Asia, but it does not…

Payment gateways are the foundation of safe and effective payment processing. Acting as a middleman,…

Every business needs access to easy and efficient payment solutions. But not every company can…

Find the Best Payment Service Provider for Your Business