International Payment Gateway List

What Is a Payment Gateway? A secure bridge between your business and the banks that…

For decades, accepting card payments meant dealing with expensive hardware terminals. Merchants relied on bulky countertop machines or mobile wireless terminals, which came with rental fees, deposits, maintenance contracts, and annoying shipping delays.

That era is ending.

We are seeing a major change in the payments landscape due to SoftPOS (Software Point of Sale), also known as “Tap to Phone”. This technology is making financial technology accessible to more people by turning the smartphones we already carry into effective payment terminals.

In this guide, we will look at how SoftPOS systems work, the strict security standards (MPoC) that keep them safe, and why this technology is becoming essential for modern commerce.

While estimates differ, all indicate strong growth.

SoftPOS is a technology that allows merchants to accept contactless card payments directly on a Commercial Off-The-Shelf (COTS) device, usually an Android smartphone or iPhone, without any extra hardware.

Using the Near Field Communication (NFC) chip found in most modern smartphones, a SoftPOS app directly interacts with a customer’s contactless card or digital wallet (like Apple Pay or Google Pay).

The process is straightforward for users but complex behind the scenes:

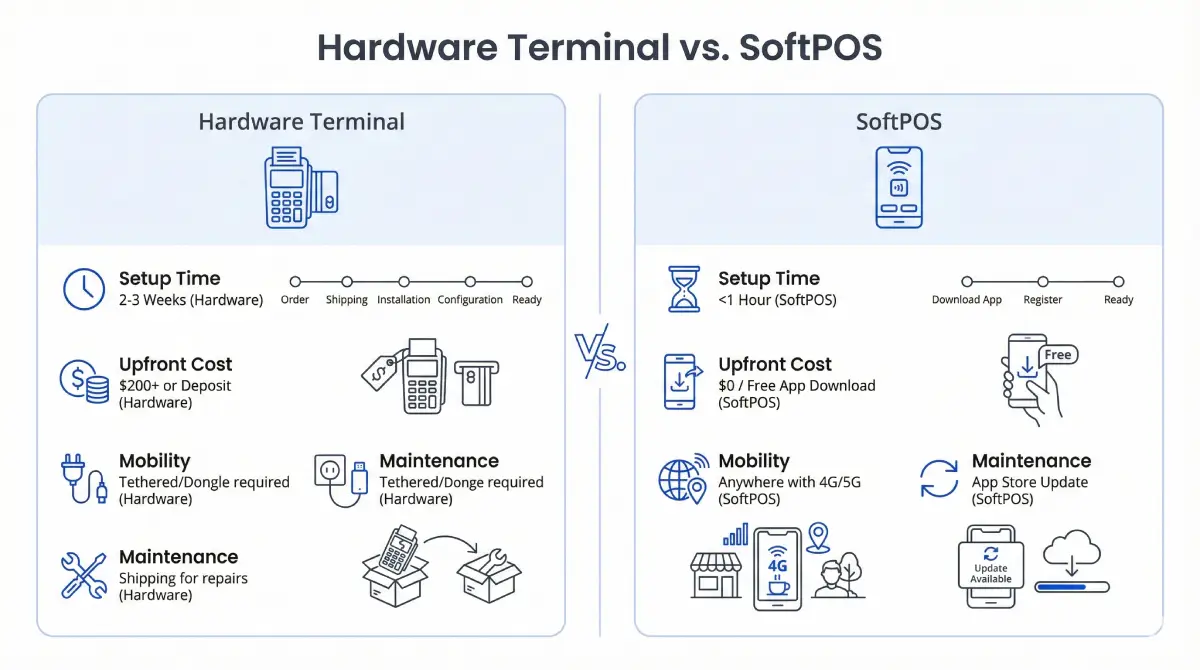

For a softpos system for small business, the advantages over legacy hardware are clear.

| Feature | Traditional Hardware Terminal | SoftPOS System |

| Setup Cost | High (Device purchase or deposit) | Low (Free app download) |

| Monthly Fees | Lease fees ($20–$50/mo per device) | Often $0 (Pay-as-you-go) |

| Mobility | Limited (Dongles or charging bases) | High (Anywhere with cellular data) |

| Maintenance | Requires shipping for repairs | Instant app updates |

| Scalability | Slow (Wait for shipping) | Instant (Download on new phones) |

For a mid-sized merchant with 10 checkout points:

For many merchants, the hesitation to adopt SoftPOS does not stem from convenience but from trust. Processing financial transactions on the same device used for social media or games raises concerns about data theft and malware.

However, SoftPOS is not merely an app on a phone. It is part of a highly regulated ecosystem governed by strict standards from the PCI Security Standards Council (PCI SSC). To gain trust in the technology, businesses need to understand the two main standards that guide it: CPoC and MPoC.

The regulation of software-based payments has quickly adjusted to keep up with technology.

When a merchant uses a SoftPOS system, security measures work behind the scenes to ensure the device is secure before and during every transaction.

Visa reports that its Tap to Phone SoftPOS solution grew by 200% year-over-year (FY2024), serving millions of merchants of all sizes. Almost 30% of these merchants are new small businesses, showing that SoftPOS is helping many small sellers enter digital payments for the first time.

“Tap to Phone is a tech equalizer for businesses. Walk into some of the world’s largest retailers or go to your local farmer’s market and they’re using this same technology to accept payments right on their phone,” said Mark Nelsen, Global Head of Consumer Products, Visa.

The move to software-based payments offers three clear advantages that hardware cannot match.

While almost any business can benefit, some industries are seeing huge returns from adopting SoftPOS systems.

Efficiency in hospitality relies on quick table turnover. Restaurant SoftPOS systems let servers take payments directly at the table right after the meal.

Urban Italian Group faced bottlenecks with shared payment terminals. Servers wasted time fetching machines, slowing down table turnover. By implementing a SoftPOS solution (integrated with Softpay), they provided every server with a payment-enabled Android device. The result was faster payments, shorter staff walking distance, and a measurable increase in table turnover during busy hours. Tips also rose due to the frictionless digital interface.

For logistics companies, outfitting 50 drivers with hardware terminals is a financial risk. Terminals often get dropped, lost, or broken.

With SoftPOS, drivers can simply use their company-issued smartphones (which they already use for navigation and signatures) to accept payment upon delivery. This merges three devices (GPS, scanner, terminal) into one.

Alaska Airlines recently implemented SoftPOS (Tap to Pay on iPhone) so 7,000 flight attendants can accept contactless payments for in-flight purchases using only their iPhones. This shows how even large companies view SoftPOS as a way to make payments mobile without needing dedicated hardware.

For seasonal markets, consultants, and tradespeople (like plumbers and electricians), carrying a card reader is one more thing to remember. A SoftPOS system ensures that as long as they have their phones, they are “open for business”.

Reuthe, a historic garden in the UK that has become an event venue, adopted SoftPOS so every staff member’s phone could act as a payment terminal. This enabled sales to happen anywhere across their 11-acre site (at the gate, a pop-up bar, and even in the alpaca feeding area!). The result was a seamless experience for visitors and a 40% increase in sales within one year of introducing SoftPOS.

Not all SoftPOS apps are the same. When you use the bilixe, a directory of payment providers, to compare companies, pay attention to these key differences:

As SoftPOS develops, it is merging with other digital trends.

The next step is Google Smart Tap and Apple’s NFC Value Added Services. These protocols allow for a “One-Tap” experience where one interaction shares both payment details and loyalty membership. A customer taps their phone, and the terminal immediately recognizes their loyalty tier, applies discounts, and processes the payment. This removes the awkward step of scanning a separate QR code or barcode.

While MPoC enabled PIN on Glass, the future lies with biometrics. We are moving toward situations where the merchant’s device can authenticate the shopper through biometrics, although privacy regulations currently limit this. Merchants may also use their biometrics, like FaceID, to securely log in and authorize high-value refunds, replacing static manager PINs.

The “terminal” is becoming an app ecosystem. Future SoftPOS apps will not only process payments but will also serve as orchestration layers. They will route transactions to different acquirers based on fees, success rates, or location optimizing the merchant’s profits in real-time.

While traditional terminals will remain crucial for high-volume places like supermarkets, where speed and durability matter most, SoftPOS is set to take over the mPOS (dongle) market and the lower to mid-range terminal market. 71% of merchants expect SoftPOS to fully replace traditional terminals by 2030, per a 2024 PYMNTS report.

Finding the right provider can be tricky. Use bilixe’s smart filters to look for payment providers that offer SoftPOS capabilities. Compare their transaction fees and read reviews from other merchants who have made the switch. To get a list of payment providers with SoftPOS solutions, simply set the “Acceptance Channels” filter to In-Store (POS/SoftPOS).

SoftPOS is a structural evolution of the payments industry. It offers scalability, flexibility, and economic efficiency that were previously unattainable. It allows financial inclusion for micro-merchants and provides operational agility for global enterprises.

For merchants, the question is no longer whether to adopt SoftPOS, but how quickly they can integrate it to stop paying for hardware they no longer need. The hardware terminal is outdated, long live the terminal app.

Recommended Articles

What Is a Payment Gateway? A secure bridge between your business and the banks that…

You are probably paying more than you need to. A few percentage points may seem…

Payment gateways are the foundation of safe and effective payment processing. Acting as a middleman,…

Find the Best Payment Service Provider for Your Business