Top 30+ Payment Gateways in India: The Ultimate 2025 List for Businesses

India’s digital payments ecosystem is thriving. It changes how merchants and consumers handle transactions online….

Digital payments have skyrocketed in recent years, making a robust payment infrastructure critical for businesses. The global digital payments transaction value is expected to show an annual growth rate (CAGR 2025-2030) of 13.63% resulting in a projected total amount of US$38.07tn by 2030. With this growth comes higher customer expectations for seamless and secure checkout. A payment orchestration platform can help meet these demands by improving success rates, reducing costs, and centralizing control across payment methods and providers.

A payment orchestration platform is a software layer or hub that streamlines the integration and management of various payment channels, gateways, and service providers. These solutions help businesses improve their payment processes. By connecting all payment flows from different providers and methods into one interface, payment orchestration platforms simplify integration, enhance transaction success rates, and offer centralized control over a business’s payment infrastructure.

Modern orchestration platforms have emerged as mission-critical for companies operating globally. The market for these platforms is growing rapidly and valued around $1.2–1.5 billion in 2023 and growing ~20–25% annually.

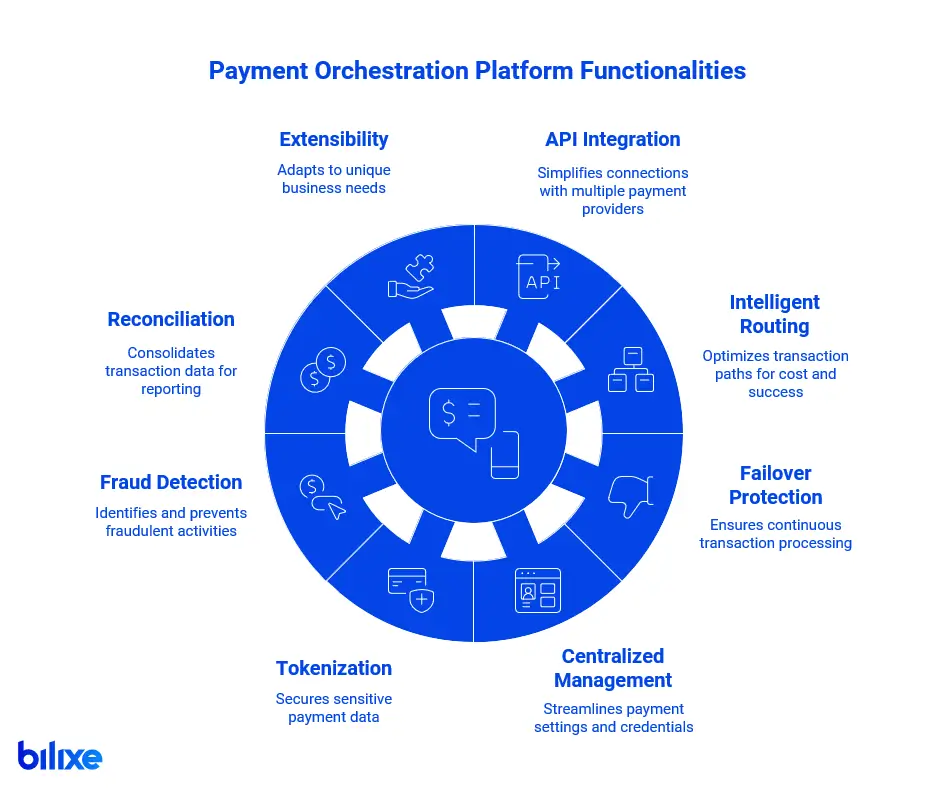

Key functionalities and how payment orchestration platforms work include:

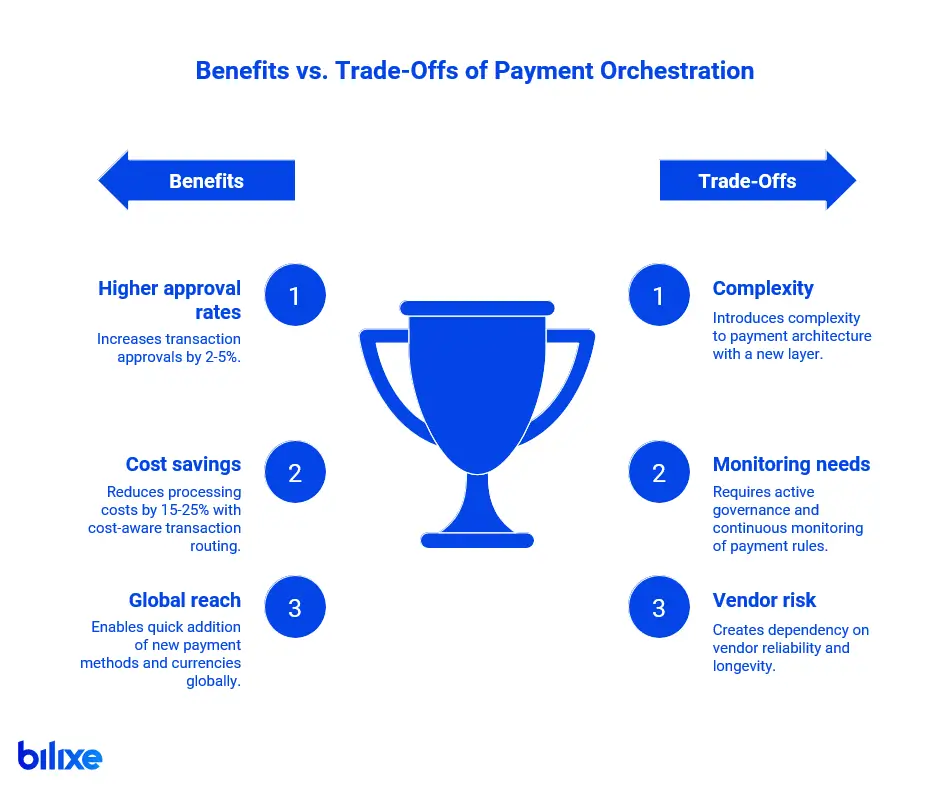

Choosing a payment orchestration platform can offer significant advantages, but there are also trade-offs:

| Benefit/Trade-Off | Category | Description |

| Benefit | Higher authorization & conversion | By leveraging smart routing, multiple acquirers, and failover, merchants typically see more transactions approved. Even a small lift in approval rate has an impact – for example, merchants report 2–5% increases in authorization success on average with orchestration. |

| Benefit | Lower processing & ops cost | Orchestration gives you the freedom to route transactions in a cost-aware way. Some reports suggest cost reductions up to 15–25% are possible in certain cases. |

| Benefit | Flexibility & global reach | Add new payment methods/currencies quickly using pre-built connectors. Industry examples show 60–80% faster time-to-market for adding new payment methods after adopting orchestration. |

| Trade-Off | Added complexity | By introducing a new layer, you inevitably add some complexity to your payments architecture. |

| Trade-Off | Governance & monitoring | The flexibility of orchestration means you’ll have many choices to configure. Merchants need to actively govern their payment rules and continuously monitor outcomes. |

| Trade-Off | Vendor reliance (third-party risk) | You are outsourcing a critical piece of your infrastructure to a vendor. This introduces a dependency on that vendor’s reliability and longevity. |

If you decide that a payment orchestration platform is right for your business, the next steps involve choosing the right provider and planning a smooth implementation.

When comparing payment orchestration vendors, ask potential providers the following questions:

Geographic Coverage & Local Methods

| # | Question | Evidence |

| ☐ | Which countries and currencies do you fully support today? Please attach a current coverage matrix. | Coverage list / matrix (CSV or PDF), dated. |

| ☐ | For our target markets {{list countries}}, which local payment methods and wallets are supported natively? | Method catalog with country mapping. |

| ☐ | Do you support multi-currency pricing and settlement? Which settlement currencies are available? Any FX or cross-border markups? | Docs on MCP/settlement flows and fees. |

| ☐ | Are there MCC/industry restrictions or regional limitations we should know about? | Acceptable use/MCC policy. |

PSP Breadth & Flexibility

| # | Question | Evidence |

| ☐ | How many PSPs/gateways are available out of the box, and can you share the full list? | Current PSP catalog with feature flags (3DS2, APMs, tokens, etc.). |

| ☐ | Can we bring our own merchant accounts with specific PSPs (BYO PSP/MAI)? Any limitations per region or brand? | BYO PSP guide and supported IDs. |

| ☐ | What is your process, SLA, and cost to add a new PSP or method on request? | Change request policy with typical timelines. |

| ☐ | Do you offer a custom connector/SDK for us to build our own integrations? | Connector SDK docs and certification checklist. |

Reliability (SLA / Uptime / Resiliency)

| # | Question | Evidence |

| ☐ | What is your contractual uptime SLA (e.g., ≥99.9%) and service credit schedule? | SLA document from the MSA. |

| ☐ | What was your 12-month historical uptime for core APIs? | Public status page export or attestation. |

| ☐ | Describe your redundancy and failover design (regions/AZs, active-active?). RTO/RPO targets? | High-level architecture/resiliency overview. |

| ☐ | How do you handle PSP or network outages (automatic failover, idempotent retries, queueing)? | Runbooks and retry/idempotency docs. |

| ☐ | Do you have scheduled maintenance windows affecting live traffic? | Maintenance policy. |

Security & Compliance

| # | Question | Evidence |

| ☐ | Are you PCI DSS Level 1? Share your latest AoC (Attestation of Compliance) and scope. | PCI AoC (current year), QSA name. |

| ☐ | Where is cardholder and personal data stored and processed (regions)? GDPR/UK GDPR compliance posture and DPA? | DPA, sub-processor list, data residency map. |

| ☐ | Do you support PSD2 SCA and 3DS2 (incl. exemptions like TRA, MIT, whitelisting)? | 3DS/SCA implementation guide. |

| ☐ | Detail tokenization (network tokens vs. proprietary vault), encryption (in transit/at rest), key management (HSM), RBAC/SSO, and audit logs. | Security whitepaper, access control policy. |

Pricing Model

| # | Question | Evidence |

| ☐ | What is your pricing structure (per-txn, % of volume, monthly flat, tiered)? Include all pass-throughs. | Rate card with tiers and definitions. |

| ☐ | Are declines, retries, 3DS, tokenization, webhooks, or FX billed? Any minimum monthly fees or commitments? | Detailed fee schedule. |

| ☐ | How do fees scale as volume doubles/halves? Are there automatic volume discounts or annual uplifts/caps? | Tiering rules and adjustment policy. |

| ☐ | Provide a worked example for our mix {{cards/APMs, auth vs. capture ratio, regions}} at {{X}} tx/month. | Pricing calculator output or pro-forma. |

Token Portability

| # | Question | Evidence |

| ☐ | Do we have a contractual right to export all tokens and underlying PAN mappings if we leave? Formats supported and timelines? | Contract clause on token/data portability. |

| ☐ | Who is the network token requestor (you or us)? Can network tokens be ported to another token service? | Tokenization architecture note. |

| ☐ | What fees and steps are involved in an exit/migration, and what downtime (if any) should we expect? | Migration playbook and fee table. |

| ☐ | What is your data deletion and retention policy post-termination? | Data lifecycle policy. |

Analytics & Reporting Depth

| # | Question | Evidence |

| ☐ | Which metrics are available out of the box (auth rate, issuer decline codes, retries, fees, chargebacks, cost per txn)? | Reporting schema or screenshots. |

| ☐ | Can we drill down by BIN, issuer, country, PSP, method, currency, and merchant account? | Dashboard demo or sandbox. |

| ☐ | How can we export data (CSV, API, webhooks, warehouse connectors)? Data latency and retention periods? | API spec, webhook docs, retention policy. |

| ☐ | Do you support automated reconciliation (settlements, fees) and payout matching? | Reconciliation guide and sample reports. |

Customer Support & Account Management

| # | Question | Evidence |

| ☐ | What support channels, hours, and response/resolve SLAs do you offer by tier? | Support SLA and severity matrix. |

| ☐ | Will we have a named CSM and solutions engineer? What’s included in onboarding and ongoing optimization (e.g., rule design)? | Engagement model slide / SOW. |

| ☐ | How do you share your product roadmap and accept merchant feedback? | Roadmap review cadence and NDA template. |

| ☐ | Can you provide 2–3 references of merchants similar to us (industry/region/volume)? | Reference contacts (under NDA). |

Beyond these, you might have specific requirements like industry-specific features, such as marketplace split payments, which not all providers handle automatically, or shopping cart integrations, like compatibility with Shopify. Make a list of your must-haves and score each vendor.

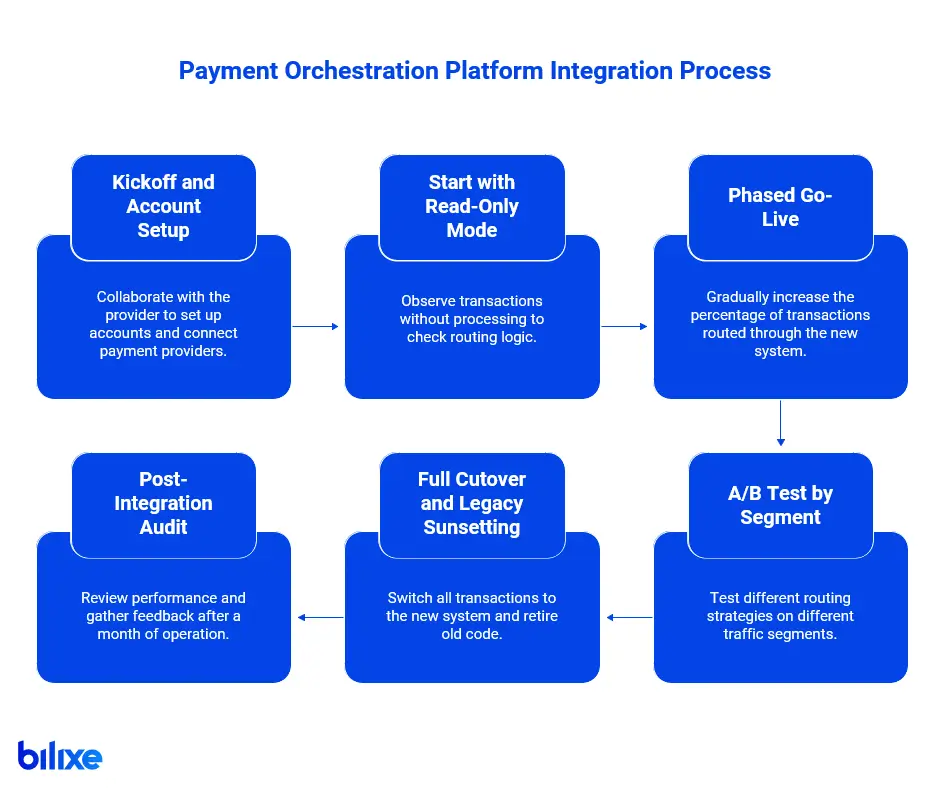

After selecting a platform, implement it carefully and in stages to ensure a smoother rollout:

The goal is to be data-driven and cautious, especially since payments are sensitive. Most orchestration platforms are accustomed to this process and can help you execute it. A careful rollout will foster confidence in the new system across your organization.

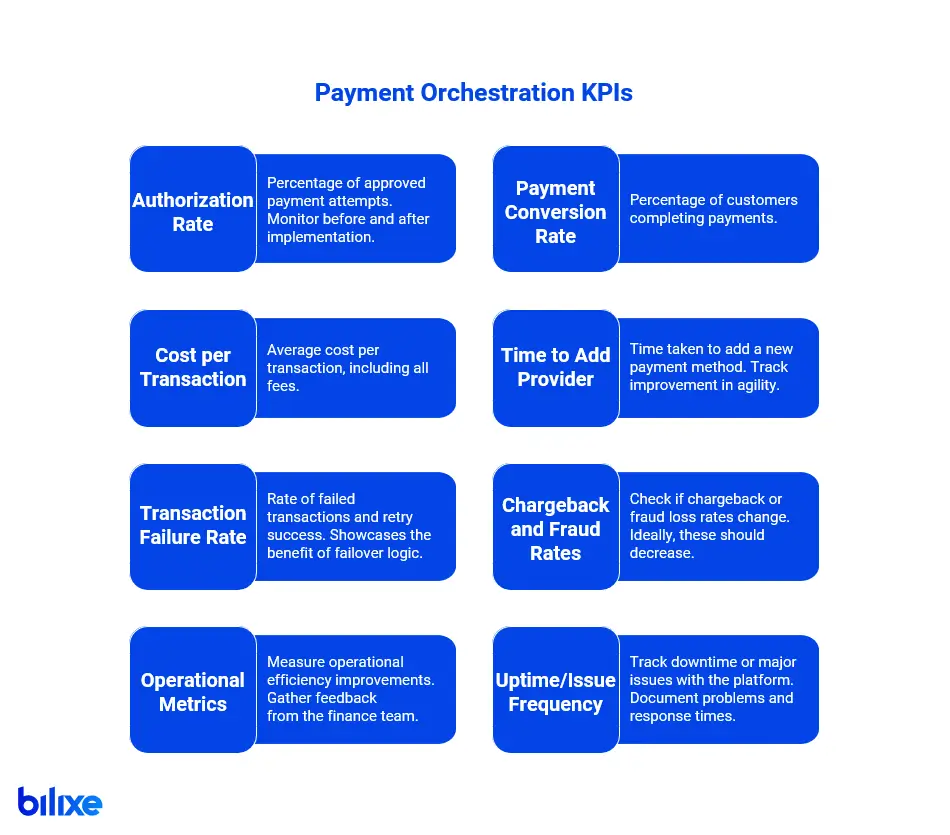

During and after implementation, track several key performance indicators (KPIs):

Regularly review these KPIs in the weeks and months post-launch. Many merchants hold weekly payment performance meetings to see trends and decide adjustments.

If you need more information to help make your choice, remember that bilixe is a free resource you can use. Bilixe provides a list of payment gateways, processors, ISOs, PayFacs, and merchant acquirers, including payment orchestration providers. By using bilixe’s filters and comparison tools, you can assess various providers side by side. For example, you can compare their coverage, fee structures, features, and even read reviews.

Payment orchestration platforms can be key to your business’s next growth stage, enabling higher revenues, lower costs, and global reach. However, success relies on selecting the right platform and implementing it carefully. Use this guide as a roadmap: understand the concept, determine if you need it, evaluate providers thoroughly, and execute in stages with clear metrics. If you do this, you’ll be well on your way to a more efficient and future-ready payment infrastructure.

Recommended Articles

India’s digital payments ecosystem is thriving. It changes how merchants and consumers handle transactions online….

Every business needs access to easy and efficient payment solutions. But not every company can…

What Is a Payment Gateway? A secure bridge between your business and the banks that…

Find the Best Payment Service Provider for Your Business