- The Role of Payment Gateways in Canada

- International Payment Gateways Offering Merchant Services in Canada

- List of Payment Gateways Offering Merchant Services in Canada

- Local Canada-Based Payment Gateways Offering Merchant Services in Canada

- List of Local Canada-Based Payment Gateways Offering Merchant Services in Canada

- Conclusion

- FAQ: Payment Gateways in Canada

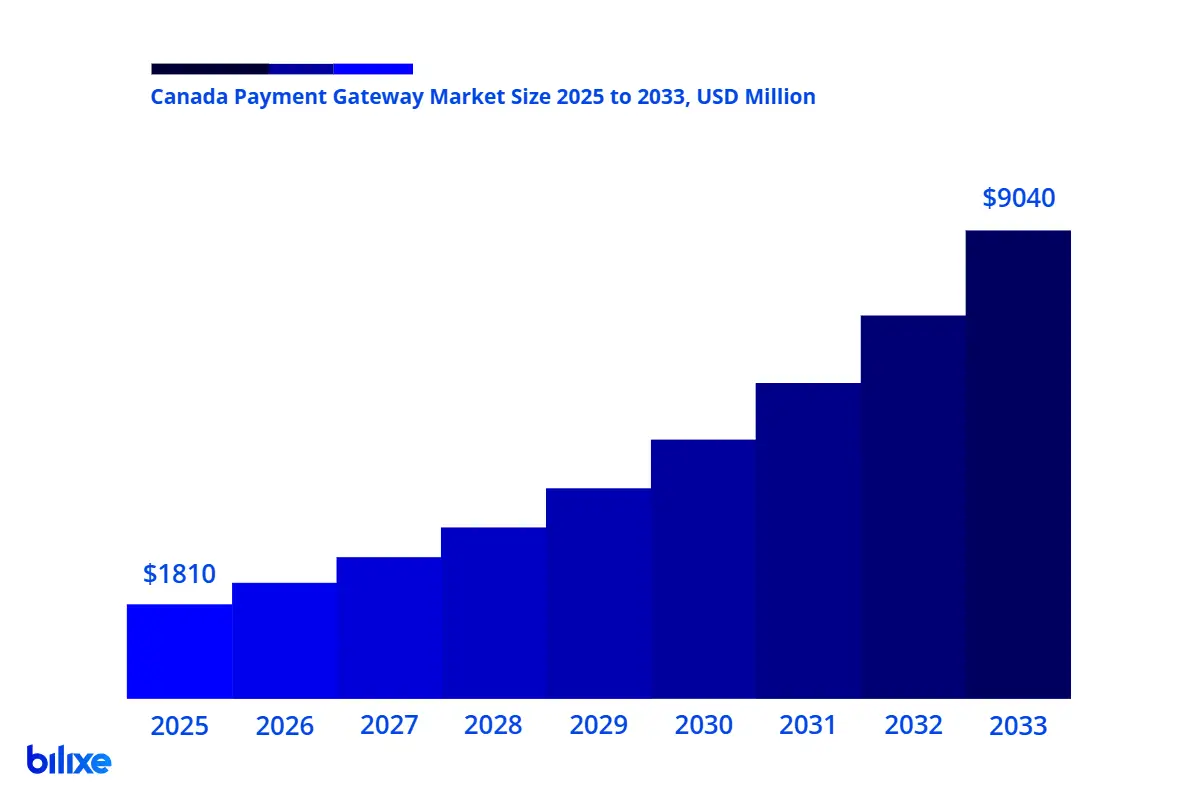

Payment gateways are the foundation of safe and effective payment processing. Acting as a middleman, they securely transfer sensitive payment information between consumers, merchants, and payment service providers. Just think about it: in Canada, digital payments already account for 86% of payment volume and 75% of payment value, making reliable gateway infrastructure vital for businesses. Forecasts project the Canadian payment gateway market at US $9.04 billion in 2033, growing at a 22 % CAGR, underlining the rapid expansion of electronic commerce and payment reliance.

We have written this guide to help businesses select the perfect payment gateway provider for Canada, with particular attention to local and international payment gateways.

The Role of Payment Gateways in Canada

A payment gateway is a service that authorizes and processes payment transactions. It makes sure that sensitive payment details, such as credit card information, are sent securely to protect both merchants and customers.

As in any other country, in Canada, payment gateways are essential for processing credit card transactions. They support major card brands such as Visa, Mastercard, and American Express, along with local methods like Interac.

You may also be interested in “Best Payment Gateways in the United Kingdom: Overview”.

International Payment Gateways Offering Merchant Services in Canada

International payment gateways are global companies that offer their services in Canada, helping businesses with wide customer bases. These gateways are particularly attractive for merchants involved in cross-border e-commerce because of their wide range of features and global reach. International payment gateways often provide no-code integration options with popular e-commerce platforms like Shopify, WooCommerce, and Magento.

Benefits of International Payment Gateways

Compared to local payment gateways, international gateways offer some benefits for Canadian businesses:

- International Reach: International gateways allow Canadian businesses to expand into new markets. They enable payments from customers outside Canada without additional movements.

- Multi-Currency Support: They process transactions in multiple currencies. Different currency conversion fees apply, depending on the providers.

- Advanced Features: Many international gateways provide useful tools, such as fraud detection, chargeback management, BNPL, white-label options, recurring billing, etc.

- Scalability: International gateways can process high transaction volumes. As a result, they are a good fit for businesses of all sizes.

Key Factors to Consider When Choosing an International Payment Gateway in Canada

Canadian businesses should look at the following factors:

- Transaction Fees: Fees usually consist of a percentage of the transaction amount plus a fixed cost (for example, 2.9% + $0.30 per transaction). It’s important to compare fee structures to ensure cost-effectiveness.

- Currency Conversion Costs: As we have previously mentioned, for businesses serving customers worldwide, it is important to know the cost of currency conversion. This is necessary to avoid surprise expenses.

- Compliance with Canadian Regulations: Make sure the gateway follows PIPEDA and PCI DSS to protect customer data and avoid legal issues.

Related reading: “How to Compare Online Payment Providers”.

List of Payment Gateways Offering Merchant Services in Canada

Local Canada-Based Payment Gateways Offering Merchant Services in Canada

Local Canada-based payment gateways are providers headquartered in Canada. They focus on serving the domestic market and offer solutions that fit Canadian businesses. They have a deep understanding of local regulations, consumer preferences, and market analytics. As an extra benefit, these providers often have partnerships with Canadian banks and financial institutions.

Benefits of Canada-Based Payment Gateways:

Local Canada-based payment gateways offer some benefits for Canadian businesses:

- Local Expertise: Local gateways know Canadian financial regulations, such as Personal Information Protection and Electronic Documents Act (PIPEDA), Payment Card Networks Act (PCNA), Retail Payment Activities Act (RPAA), Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA), and can offer more suited solutions.

- Support for Local Payment Methods: They provide easy integration with payment methods preferred by Canadians.

- Lower Fees for Domestic Transactions: Local gateways may offer lower fees for CAD transactions compared to international providers.

- Regional Considerations: For businesses in specific regions, like Ontario, local gateways can provide even more tailored solutions. Credit card processing in Ontario often involves high transaction volumes due to the province’s role as a commercial center. Local gateways may offer specialized support for POS systems and work better with regional banks, improving efficiency for businesses in this area.

Key Factors to When Selecting a Local Payment Gateway in Canada

Canadian businesses should keep the following in mind:

- Features Available: Local gateways might lack some advanced options available from international providers (for instance, anti-fraud solutions, chargeback management, etc.).

- International Capabilities: If your business plans to grow globally, make sure the gateway can handle international transactions or work with other providers.

- Scalability: Double check that the gateway can support your business as it grows over time.

List of Local Canada-Based Payment Gateways Offering Merchant Services in Canada

Conclusion

International payment gateways provide global reach, multi-currency support, and advanced features. Primarily they are a perfect match for Canadian businesses with an international customer base. Canada-based gateways offer local expertise in the Canadian market, compliance with domestic laws, and support for popular payment methods.

To make the process of choosing payment gateway easier, Canadian businesses can use bilixe’s platform. Bilixe provides a detailed database of payment processing companies in Canada. With our useful filters, Canadian merchants can compare gateways based on transaction fees, regions supported, integration options, compliance certifications, and more.

FAQ: Payment Gateways in Canada

Recommended Articles

Best Credit Card Processing for Small Business [Guide]

According to the Federal Reserve survey, about 80% of small businesses face payment-related challenges. That…

Payment Gateway vs Payment Processor: What’s the Difference?

What Is a Payment Gateway? A payment gateway is a technology that enables merchants to…

Credit Card Processing Companies for Nonprofit Organizations

What Is Nonprofit Organization? Nonprofit organizations are mission-driven entities that exist to serve the public…

Find the Best Payment Service Provider for Your Business