- What Is a High Risk Business in the U.S.?

- High Risk Industries in the USA: A Sector-by-Sector Breakdown

- Why High Risk Payment Gateways In The USA Are Necessary

- Key Factors in Choosing a High Risk Payment Gateway in the USA

- List of High Risk Payment Gateway Providers in the USA

- FAQ: Best High Risk Payment Gateways in the USA

U.S. merchants in high risk industries often have trouble finding payment processing solutions due to the high risk of fraud and chargebacks associated with their businesses. Let’s take a closer look at what defines a high risk business and why specialized high risk payment gateways in the USA are essential.

What Is a High Risk Business in the U.S.?

A high risk business is usually one that experiences more fraud, chargebacks, or regulatory scrutiny because of its industry or business model. For instance, sectors like adult entertainment, online gambling, firearm or vape sales, and CBD or cannabis products are often labeled as high-risk due to legal restrictions or high chargeback rates. Businesses with subscription billing models or international customers also fall into this category. These factors make banks and payment processors regard these businesses as risky, which leads to fewer approvals from standard payment processors.

High Risk Industries in the USA: A Sector-by-Sector Breakdown

Although underwriting decisions happen on a case-by-case basis, many industries are routinely classified as high risk in the U.S. market because of the factors mentioned above.

Regulated and Controversial Products

This group includes industries that face strict legal guidelines, regulatory oversight, and potential reputational issues for acquiring banks:

- Adult Entertainment, Online Gambling, and Gaming: These sectors have high chargeback rates and complex legal requirements.

- Firearms, Tobacco, Vaping, and CBD/Cannabis Products: These industries are high risk due to heavy regulations and changing legal situations.

- Nutraceuticals and Dietary Supplements: These businesses often face scrutiny about product claims, which leads to more customer disputes and chargebacks.

High Chargeback and Cancellation Prone Services

These industries involve business models where the value of the service can be subjective or the delivery is delayed, which increases the chances of disputes:

- Travel and Tourism: Airlines, travel agencies, and tour operators can experience cancellations from factors like weather or political unrest, leading to many chargebacks.

- Subscription Services and Telemarketing: Recurring billing models are vulnerable to “friendly fraud” and customer disputes.

- Tech Support, Coaching, and Consulting: The intangible nature of these services can result in disagreements over value and quality, causing chargebacks.

High-Value and Fraud-Prone Goods

This group includes e-commerce sectors like electronics and jewelry. Online stores that sell expensive items attract fraudsters who use stolen credit card information to buy goods for resale, making these merchants high risk.

Complex Financial and Legal Services

This category includes:

- Credit Repair, Debt Collection, and Payday Lenders: These industries face strict regulatory checks and serve financially stressed clients, raising their risk.

- Certain Legal Services: Law firms that focus on contentious areas like bankruptcy or personal injury can be seen as high-risk due to billing practices and potential disputes.

Emerging and Volatile Markets

This includes cryptocurrency. The inherent instability of digital currencies and a fast-changing regulatory environment put crypto exchanges and related services in the high risk category.

☝️ Interesting Fact

Visa explicitly designates several high brand risk merchant types for card-not-present payments and requires special acquirer/HRIPF registration. MCCs called out include 5122/5912 (drug/drugstores), 5962/5966/5967 (direct marketing & telemarketing, incl. digital adult), 5993 (cigars), 7273 (dating), 7995 (betting/gambling) and certain high risk activities under MCC 4816 (cyberlockers), 5816 (digital gaming), and 6051 (crypto purchases/wallet funding/ICOs).

Challenges for High Risk Merchants in the U.S.

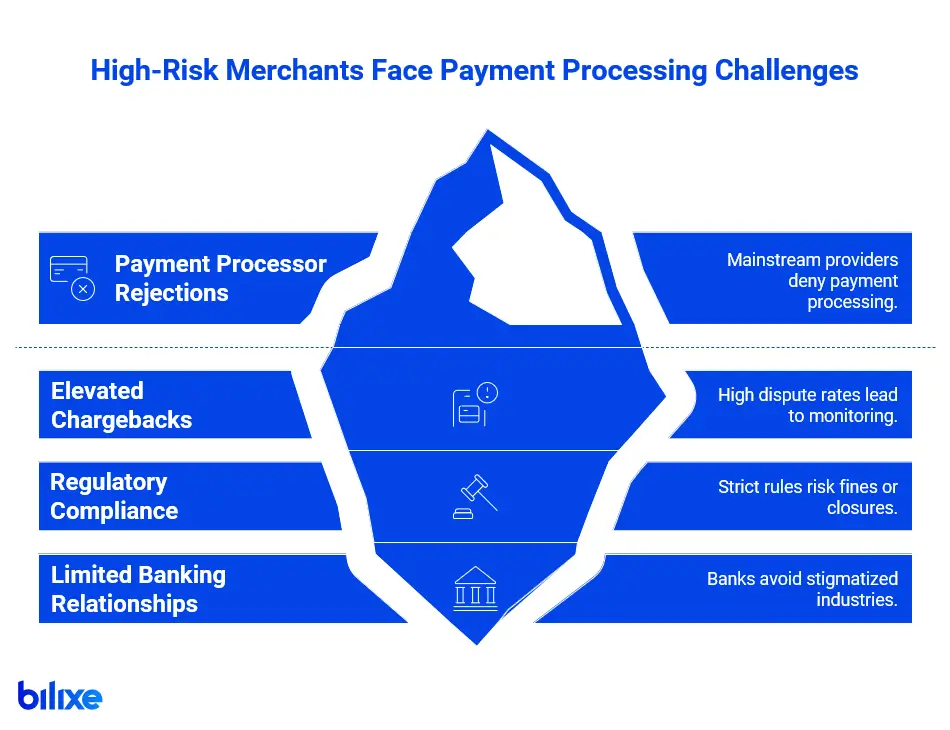

Merchants in high risk sectors in the U.S. often deal with major challenges in payment processing. Key challenges include:

- Payment Processor Rejections and Instability: Frequent rejections, account freezes, or terminations from standard providers occur due to risk avoidance. For instance, a CBD retailer might get rejected by banks for regulatory reasons.

- Elevated Chargebacks and Fraud Exposure: Higher rates of disputes from issues like subscription cancellations or fraud can lead to monitoring programs or even shutdowns. Chargeback rates in high-risk sectors can go as high as 5.99% net charge-offs, which have tripled since 2021.

- Regulatory Compliance and Licensing: Strict regulations (e.g., FDA for supplements or age verification for adult content) across states or internationally can result in fines or closures.

- Limited Banking Relationships: Banks tend to avoid stigmatized industries, resulting in poor support and limited account options.

Why High Risk Payment Gateways In The USA Are Necessary

Given the challenges with traditional processors, high risk payment gateways are crucial for these businesses. These specialized payment gateway providers are willing to deal with industries that regular processors shy away from. This allows high risk merchants to accept credit card and online payments securely. They usually understand the specifics of high risk industries and can manage the higher fraud and chargeback risks. Essentially, high risk gateways provide services and support catered to businesses that would otherwise have difficulty finding viable payment processing options.

Related reading: “High Risk Payment Gateways in LATAM: The Expert Guide”.

Key Factors in Choosing a High Risk Payment Gateway in the USA

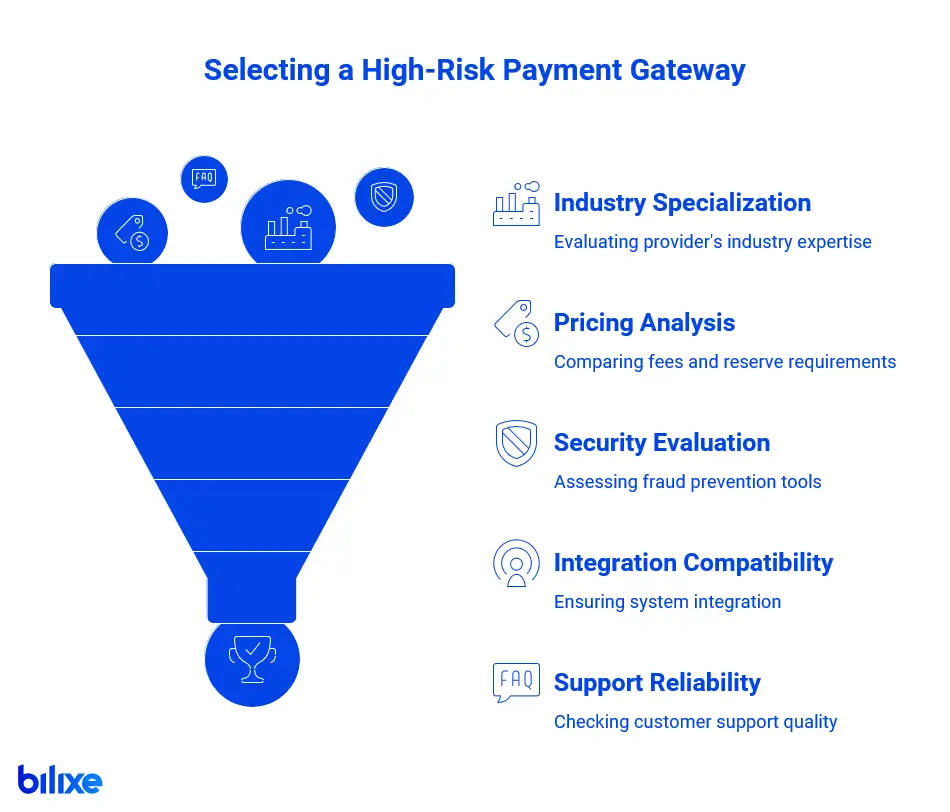

When selecting the right high risk payment gateway in the USA, you should evaluate providers based on several important criteria to ensure they can meet your business’s needs.

Industry Specialization & Approval Rates

Look for providers that focus on or have a strong history with your specific industry. This can increase your chances of approval and show that they understand your business model. A gateway experienced with high risk industries, such as gaming, adult entertainment, or supplements, is more likely to successfully onboard your business and provide features tailored to your needs.

Pricing, Fees & Reserve Requirements

High risk merchant accounts typically come with higher transaction fees compared to standard accounts. When comparing gateways, pay attention to their pricing model, including this includes transaction rates, monthly fees, chargeback fees, and any required rolling reserves, which involve holding a percentage of your funds as security. Choosing a provider with clear fees and fair reserve terms can significantly impact your bottom line.

Fraud Prevention & Security Tools

Strong security is essential for high risk payment processing. Global card-payment fraud reached $33.83 billion in 2023, with $14.32 billion in the U.S. alone. Choose gateways that offer strong fraud detection tools, such as real-time monitoring, velocity checks, and automated chargeback alerts to help protect your revenue. Ensure the provider adheres to top security standards, like being PCI DSS Level 1 certified, and uses encryption or tokenization to protect sensitive data. Effective fraud prevention and security features can reduce losses and indicate to banks that you manage risk actively.

Integration Options & Support

Consider how well the payment gateway will fit with your business’s current systems, like your e-commerce platform, shopping cart, or billing software. Leading high risk gateways usually offer various integration options, including APIs, plugins, or hosted payment pages, to cater to different technical needs. Additionally, dependable customer support and account management are vital. High risk businesses benefit from quick responses, especially when dealing with fraud issues or account reviews. A provider known for good support and fast issue resolution can save you time and minimize disruptions to your payment processing.

List of High Risk Payment Gateway Providers in the USA

Below is a list of high risk payment gateways that serve U.S. merchants in high risk industries. Each provider is recognized for working with high risk businesses and offers various features and pricing options suited to sectors from online gaming to nutraceuticals.

FAQ: Best High Risk Payment Gateways in the USA

Recommended Articles

Popular Payment Methods in Asia: Country-by-Country Guide

Understanding payment methods by country helps merchants localize checkout, reduce friction, and improve approval rates….

International Payment Gateway List

What Is a Payment Gateway? A secure bridge between your business and the banks that…

Hosted Payment Pages vs. API Integration: Security and UX

The checkout page is the key moment for any online business. It is the point…

Find the Best Payment Service Provider for Your Business