Payment Gateway vs Payment Processor: What’s the Difference?

What Is a Payment Gateway? A payment gateway is a technology that enables merchants to…

According to the Federal Reserve survey, about 80% of small businesses face payment-related challenges. That is why small businesses need a reliable way to accept credit card payments to keep sales steady and grow. The best credit card processing for small businesses depends on finding a service with low fees, easy setup, and strong customer support.

There are many payment companies providing services to small businesses. Each offers different pricing, hardware, and service features. To pick the best one for your business, you should consider factors like cost, ease of use, and flexibility.

Accepting credit card payments involves several steps and different types of companies working together. Knowing how the process flows and the role of each company helps you choose the right service for your business.

There are three key types of payment companies involved:

You may often find companies that combine some of these roles.

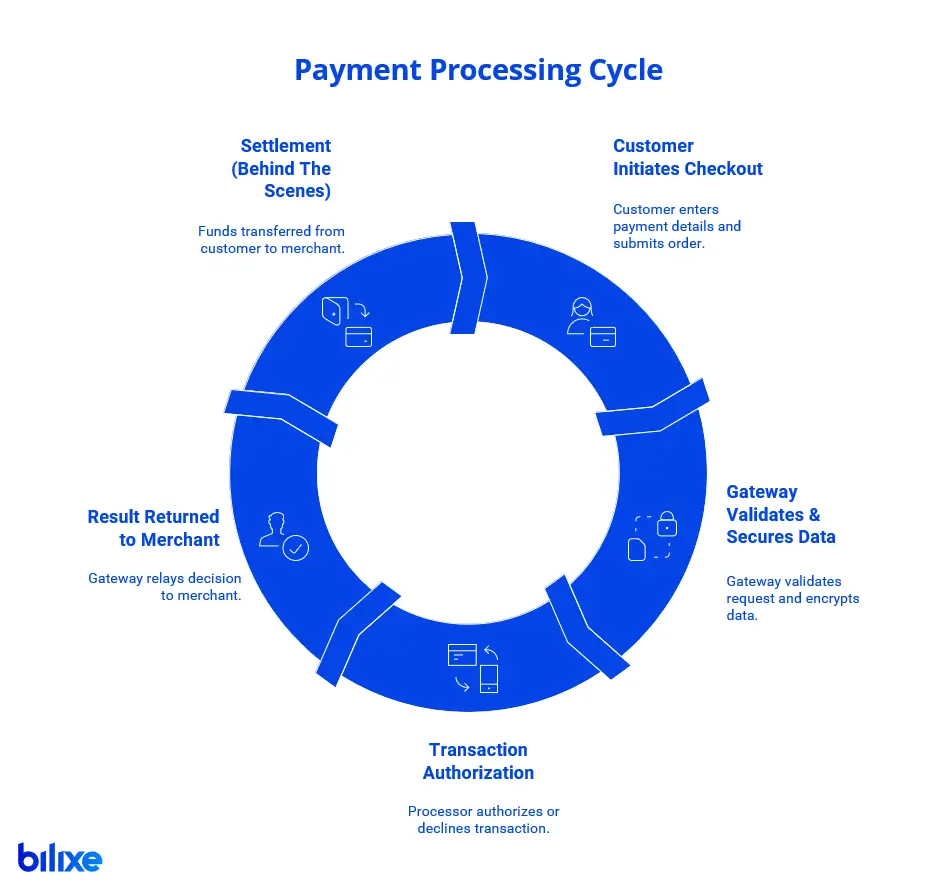

When a customer pays by credit card, the process starts with capturing the card information. This can happen in person with a card reader or online through a payment form. The card data is sent securely to a payment gateway, which acts like a digital bridge.

The payment gateway forwards the data to the payment processor. The processor communicates with the customer’s bank, also called the issuing bank, to check if the card is valid and if funds are available. Once approved, the processor sends authorization back through the gateway to your system.

Finally, the money moves from the customer’s bank to your merchant account. This usually happens within a few business days. Each step happens quickly and uses secure technology to protect sensitive data.

Cost matters. A recent survey found that 59% of small businesses would switch their payment processor if it meant getting lower transaction fees, even though the vast majority are otherwise satisfied. Choosing a provider with affordable processing fees can thus be a game-changer. Processing fees usually include a mix of fixed charges and percentages based on each transaction.

Credit card processing fees often include a percentage of each transaction, usually around 1.9% to 3%, plus a flat fee per transaction, typically ranging from $0.10 to $0.30.

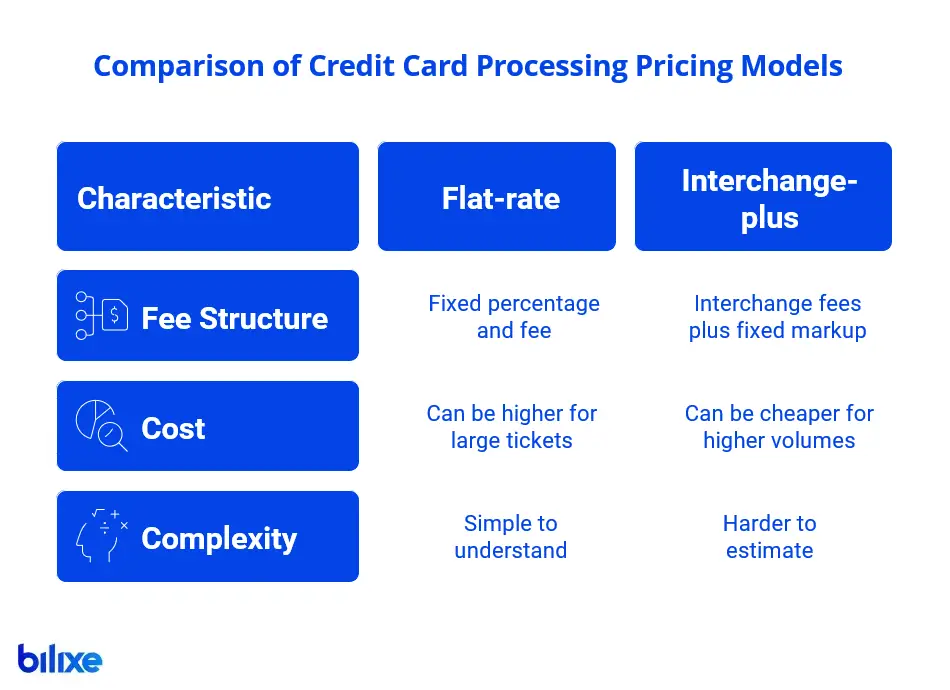

There are two main pricing models for SMBs:

You may also see fees for chargebacks, monthly minimums, or PCI compliance. You can find more information about fees in our blog post on how to lower payment gateway fees.

Some payment service providers offer credit card processing for small business with no monthly fee and charge only per transaction. These no-fee plans are often among the cheapest credit card processing for small business setups, especially for startups or seasonal businesses that want to avoid fixed costs.

Examples include popular services like Square or Stripe, which don’t require a monthly fee but charge around 2.6% + $0.10 to $0.30 per swipe or tap.

You usually get basic features like online payment options and simple reporting with no monthly fees. But premium tools or hardware may cost extra.

You should watch out for:

These can add up and reduce your profit. Always read the agreement closely before choosing a credit card processing provider.

Related reading: “Credit Card Processing Companies for Nonprofit Organizations”.

You want a credit card processing provider that fits your business needs, offers clear pricing, and supports easy payment handling. Knowing the strengths of leading providers, the key features they offer, and how these benefit small businesses helps you make the right choice.

When comparing credit card processing companies, look for these features: fee structure, POS systems, customer support, and integration options. For example, a U.S. Chamber guide notes that leading solutions tend to have low transaction fees, strong customer support, and transparent pricing.

Below, you can find credit card processing for small business comparison*:

Fee structure: Flat rate.

Setup fee: $0.

Monthly fee: $0.

Transaction fees: In‑person card‑present: 2.6% + $0.15. Card‑not‑present online: 2.9% + $0.30. Manually‑entered: 3.5% + $0.15.

POS Systems: Yes.

Online payments: Yes.

Customer support: 24/7

Integration options: API, Hosted Page, iFrame, Plugins.

Supported eCommerce plugins: BigCommerce, Magento, Shopify, Wix, WooCommerce.

Unique benefits for SMB: Free POS app, fast setup.

Fee structure: Flat rate.

Setup fee: $0.

Monthly fee: $0.

Transaction fees: 2.9% + $0.30.

POS Systems: No.

Online payments: Yes.

Customer support: Online only.

Integration options: API, Hosted Page, Plugins.

Supported eCommerce plugins: BigCommerce, Magento, Salesforce, SAP, WooCommerce.

Unique benefits for SMB: Developer-friendly API.

Fee structure: Flat rate.

Setup fee: $0.

Monthly fee: $0.

Transaction fees: Standard rates include 2.99% + $0.49 (Cards), 3.49% + $0.49 (PayPal/Venmo), 4.99% + $0.49 (Pay Later). International adds 1.5%.

POS Systems: Very limited.

Online payments: Yes.

Customer support: 24/7.

Integration options: API, Hosted Page, Plugins.

Supported eCommerce plugins: BigCommerce, Shopify, WooCommerce, Wix, Magento, OpenCart, Shopware, Squarespace, Miva, GoDaddy, Shift4Shop, Vortx, ShopSite, Ecwid, Lightspeed, Salesforce, Bold, UltraCart, commercetools, RocketRez, nopCommerce, SmarterCommerce, ThriveCart, BrainCert, RevolutionParts, Checkout Champ, RomanCart, Addmi.

Unique benefits for SMB: Widely accepted, easy online.

Fee structure: Interchange Plus.

Setup fee: $0.

Monthly fee: $0.

Transaction fees: In-person: 1.93% + $0.08. Keyed & Online (Average): 2.49% + $0.25. Online ACH Bank Payments: 0.5% + $0.25.

POS Systems: No.

Online payments: Yes.

Customer support: 24/7.

Integration options: API, Hosted Page, iFrame, Plugins.

Supported eCommerce plugins: FoxyCart / Foxy.io, Great Exposure, QuickBooks, WooCommerce, Xero.

Unique benefits for SMB: Transparent pricing.

Fee structure: Flat rate, Tiered pricing.

Setup fee: $0.

Monthly fee: $0 – $114.85+.

Transaction fees: Transaction fees vary by plan. In-person: 2.3% + $0.10 to 2.6% + $0.10. Card-not-present: 3.5% + $0.10.

POS Systems: Yes.

Online payments: Yes.

Customer support: Phone + online chat.

Integration options: API, Plugins.

Supported eCommerce plugins: Shopify, WooCommerce, Magento (US and Canada only).

Unique benefits for SMB: Wide range of POS terminals.

*Please note that all information provided above is stated as of the date this article was written and may change over time. We make no guarantees regarding the accuracy or completeness of the information presented. Always verify the details independently before making any decisions.

Fees vary by transaction volume and sales type. Some charge monthly fees while others don’t. Understanding your sales mix helps you pick the best fit.

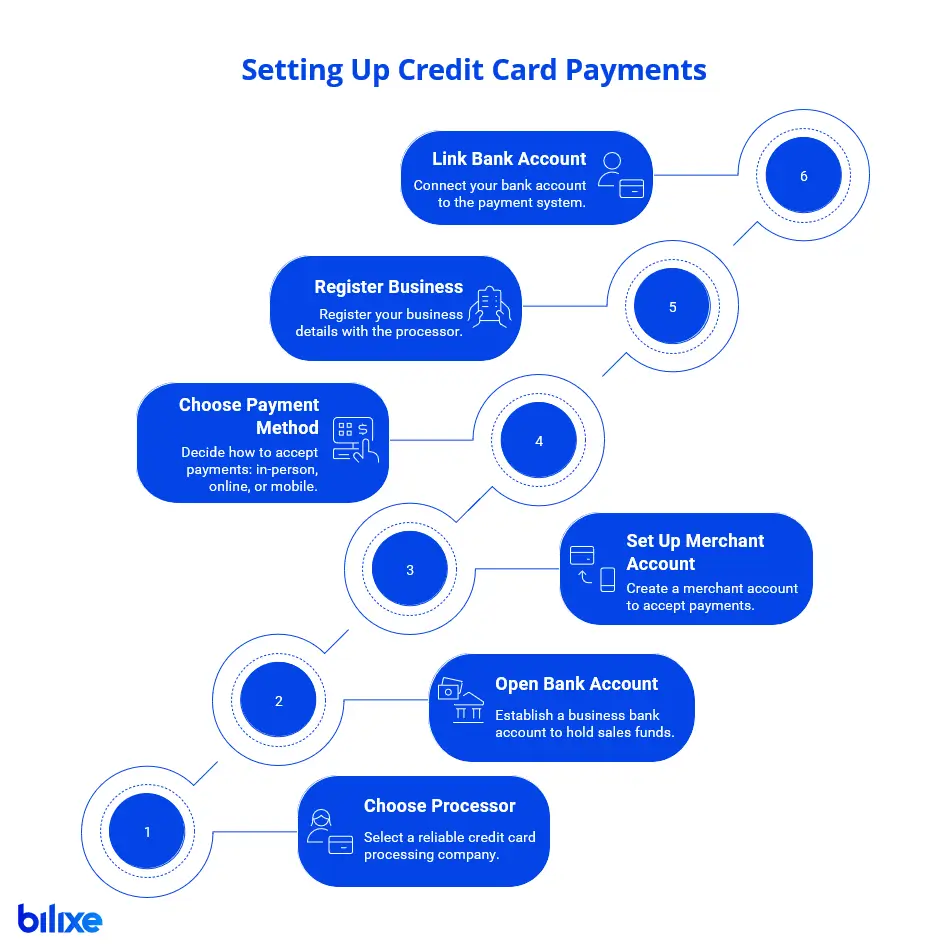

To start accepting credit card payments, you need to make clear choices about your payment provider, hardware, and security. Setting up involves selecting a processor, connecting necessary systems, and following rules to keep transactions safe.

First, choose a reliable credit card processor. Popular options include Square, PayPal, Stripe, and Clover. Next, open a business bank account if you don’t already have one. This account will hold your funds from sales.

Then, set up a merchant account either through your processor or a third party. This lets you accept payments and receive transfers. Afterward, pick how you want to accept payments: in-person, online, or via mobile devices.

Finally, register your business details with the processor and link your bank account. This completes the setup and allows you to start processing payments.

Your payment processor should work smoothly with your point of sale (POS) system. Many payment service providers offer built-in POS solutions or integrate easily with popular systems like Square POS. In addition, modern POS technology isn’t just about processing sales. Today, many view modern POS systems as tools for customer engagement, including loyalty programs and data insights, along with managing payments.

Choose hardware based on your business type. For retail, countertop terminals work well. Mobile businesses may prefer card readers thMake sure your POS supports the payment types your customers use, including contactless, chip cards, and mobile wallets. Integration should also sync sales data with your inventory and accounting software to keep operations efficient.at connect to smartphones or tablets.

To protect your customers and your business, follow PCI DSS rules. These set standards for safely handling credit card data. Your processor often helps with compliance, but you must stay vigilant and get confirmation from the payment provider in advance.

Also, confirm your provider offers fraud detection and alerts. Card fraud is a growing concern as global payment card losses hit nearly $34 billion in 2023, a cost that small businesses can barely absorb. Anti-fraud tools flag suspicious transactions early. Following these steps protects your business from costly data breaches and chargebacks.

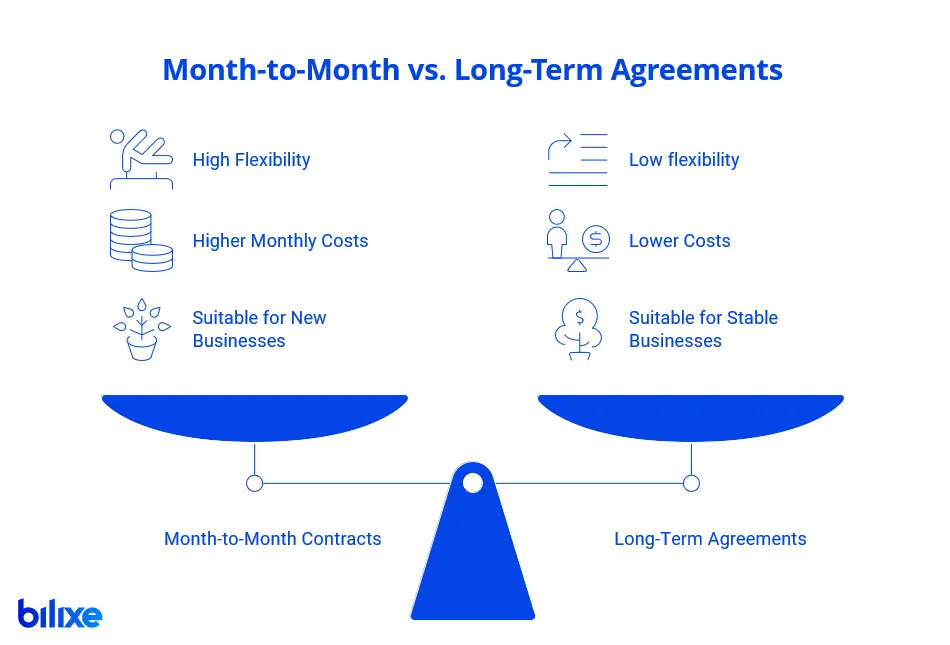

Another important step on the way to accept credit card payment for small businesses is to complete all legal formalities. You need to understand the types of contracts and their flexibility. This affects your credit card processing costs and how easily you can adapt if your business needs change.

Month-to-month contracts let you pay for services monthly without a long commitment. This gives you freedom to switch providers if fees rise or your needs change. However, month-to-month rates are often higher than long-term deals.

Long-term agreements, usually 1 to 3 years, offer lower processing fees. But you must stick with the provider for the contract length. These contracts may include discounts on equipment or bonus features.

If your business is new or expecting rapid change, a month-to-month contract may suit you better. For stable businesses looking to reduce credit card processing costs, a long-term plan might be best.

Look closely at early termination fees and notice period before signing any contract. Many long-term agreements charge a penalty if you want to leave early. These fees can be expensive and cut into your profits.

Ask for a detailed fee schedule in writing. This helps you avoid surprises and protects your cash flow.

Key concerns to check:

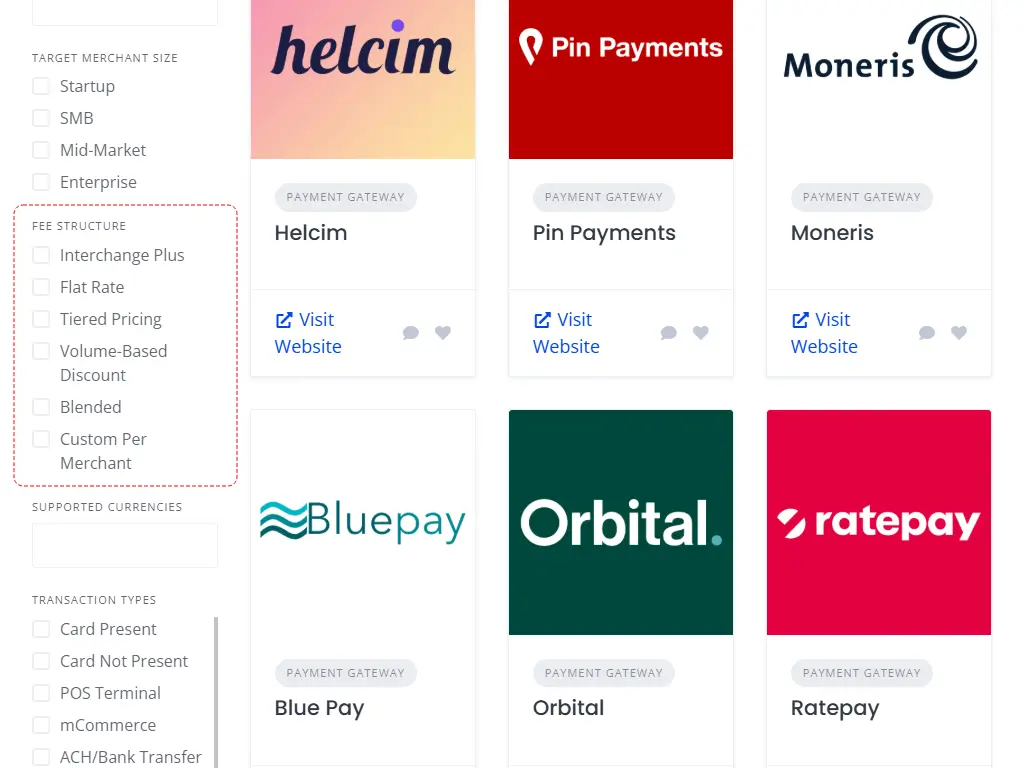

Bilixe uses smart filters to help you quickly find the top credit card processing for small business or compare the cheapest credit card processing for small business options by setup fees, monthly charges, and transaction costs. This saves time and helps you avoid options that don’t fit your goals or budget.

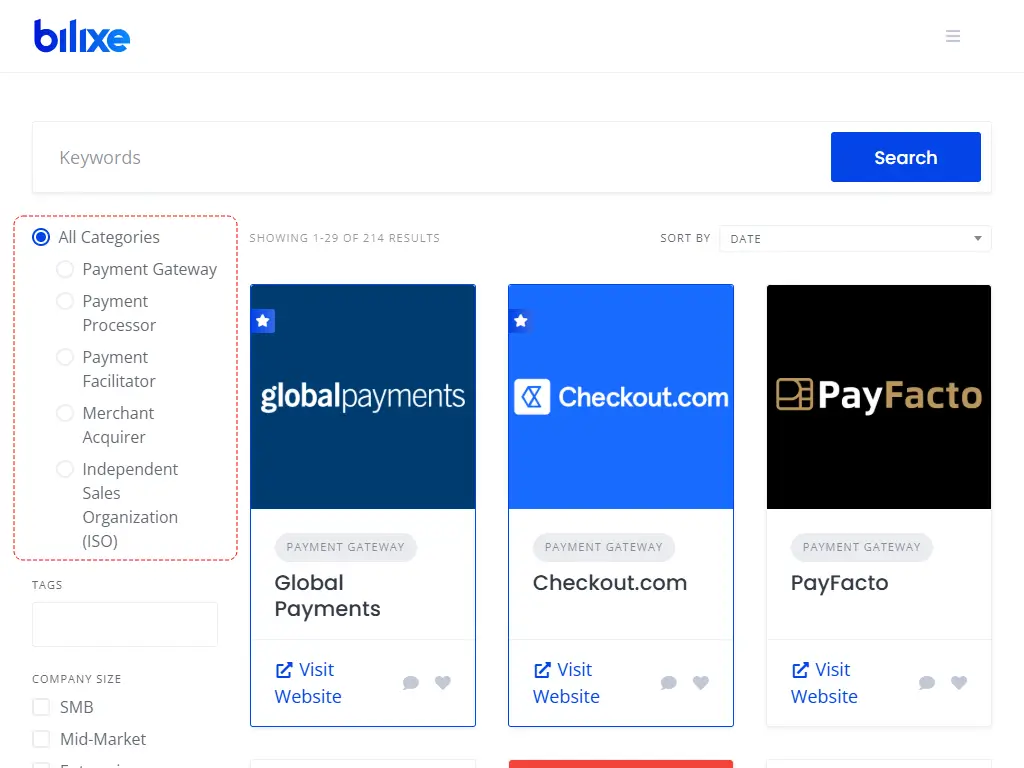

Bilixe lets you filter by the kinds of payment companies you want.

You can choose between payment gateways, merchant acquirers, or payment processors.

This filter helps you match the right type of service to your business model, whether you sell online, in person, or both. You can focus on providers that specialize where you need them most.

From time to time, we publish curated lists of payment service providers tailored to various use cases, such as:

Top 30+ Payment Gateways in India: The Ultimate List for Businesses

Best Payment Gateways in the United Kingdom: Overview

Canada Payment Gateway Guide: Top Picks

Visit our blog for the latest publications. We’re confident you’ll find something useful!

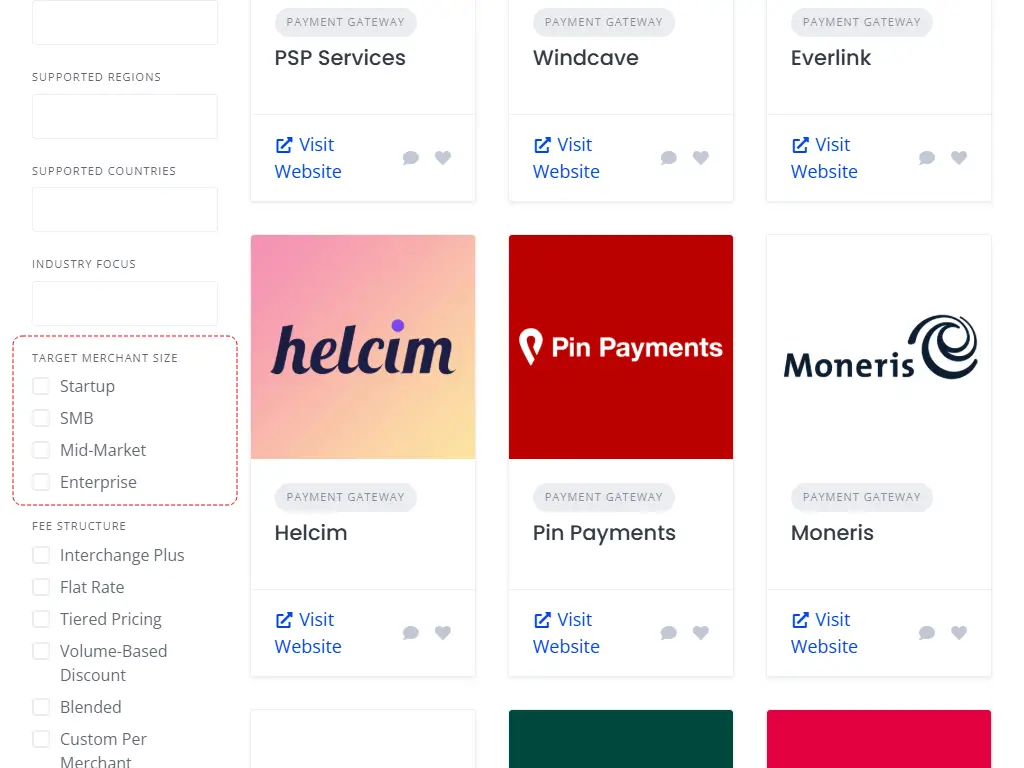

Not every processing company suits every business size. Bilixe lets you filter by merchant size categories: Startup, SMB (Small to Medium Business), Mid-Market, and Enterprise.

If you run a startup, you may want providers with low fees and easy setup. SMBs often need more features and faster support.

Fee structures can vary a lot, so bilixe offers detailed fee filters. You can set limits on “Fee Structure” like

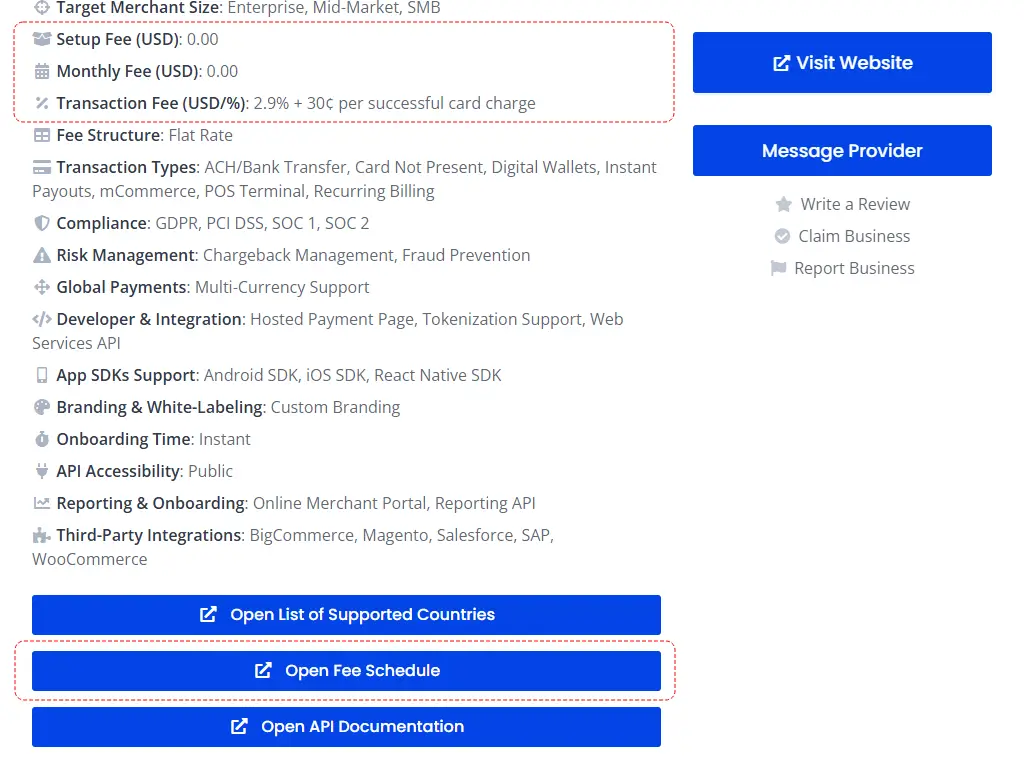

Additionally, in the payment provider’s profile, you will be able to find a link to the fee schedule (if it was made public by the provider) and see fee-related information about:

This helps you find companies with transparent credit card processing costs that fit your budget. You can avoid surprise fees and compare pricing models easily.

Use these filters to find payment service providers that keep fees low for your sales volume and transaction size.

Explore the listings to apply these filters and discover the best credit card processing company for your small business.

Recommended Articles

What Is a Payment Gateway? A payment gateway is a technology that enables merchants to…

Digital payments have skyrocketed in recent years, making a robust payment infrastructure critical for businesses….

Introduction Finding the right online payment provider is crucial for businesses of all sizes. Whether…

Find the Best Payment Service Provider for Your Business