- B2B Payments Market Size

- What Are B2B Payments?

- Main B2B Payment Methods (With Pros and Cons)

- Top Challenges in B2B Payment Processing (and Why They Still Exist)

- Benefits of Using B2B Payment Solutions

- List of Leading B2B Payment Gateways

- A Smarter Way to Discover B2B Payment Solutions with Bilixe

- FAQ: B2B Payments

Businesses today handle trillions of dollars in B2B transactions, but many are still using outdated or B2C tools. These tools can waste time, money, and trust. In this guide, we’ll cover everything you need to know about B2B payments and help you find better ways to manage them.

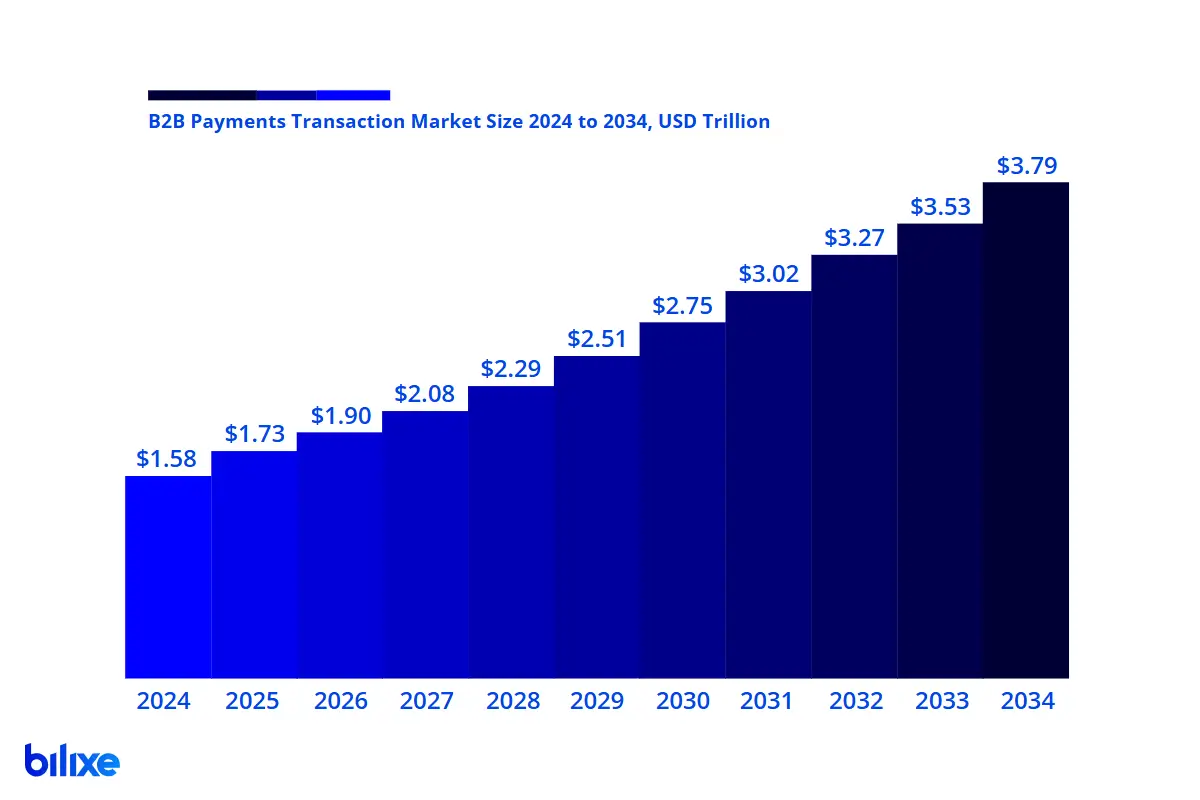

B2B Payments Market Size

The B2B payments market is huge. According to Precedence Research survey report, business to business payments market size was estimated at USD 1.58 trillion in 2024 and is expected to hit around USD 3.79 trillion by 2034, poised to grow at a compound annual growth rate (CAGR) of 9.14% from 2025 to 2034.

This market is roughly twice the size of the business to consumer (B2C) payments market. Given the scale and complexity, many businesses need specialized B2B payment solutions to handle their transactions effectively. To understand why business to business payments need specific solutions, let’s begin with the basics: what are B2B payments, and how do they differ from B2C?

What Are B2B Payments?

B2B payments, or business to business payments, are transactions where one business pays another for goods or services. These can be one-time purchases, like buying equipment, or recurring transactions, such as monthly wholesale orders or service fees. Payments can be domestic or cross-border, and methods range from traditional paper checks to electronic bank transfers and credit card payments.

Why do businesses sometimes need specific B2B payment solutions instead of B2C options? The main reason is that B2B payment processing has unique requirements and challenges that consumer-oriented payment tools may not meet.

B2B Payments vs. B2C Payments: Key Differences

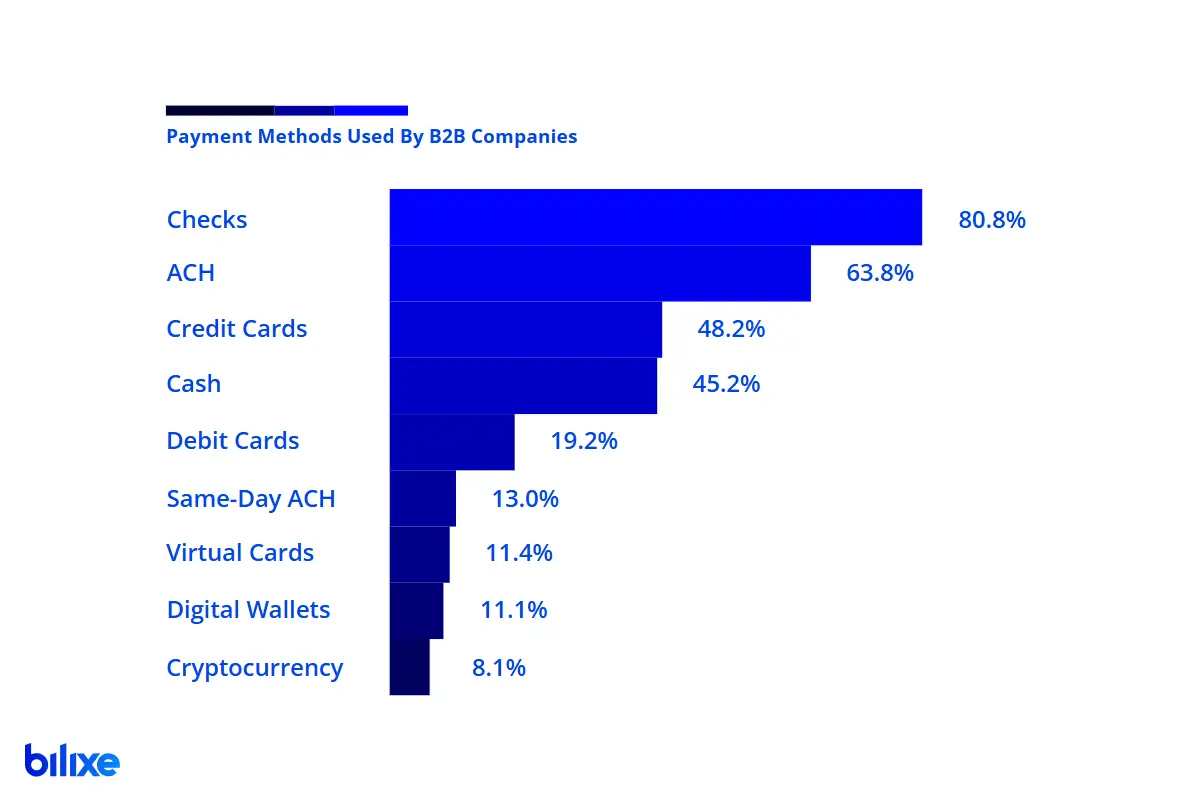

Main B2B Payment Methods (With Pros and Cons)

Let’s break down the main methods businesses use today to send and receive B2B payments.

According to a Getbalance survey, checks are used by about 80% of B2B firms, followed by ACH transfers (~64%) and credit cards (~48%). Cash payments are also used by ~45% of companies, while newer digital options like digital wallets or virtual card payments see adoption around only 11%.

Checks

Traditional checks have been a common method for B2B payments, especially in the U.S. Checks are simple but slow. Mailing and manual processing can take days or weeks, and reconciling them takes a lot of work. They are also somewhat vulnerable to fraud, like check forgery.

ACH Transfers (Bank Transfers)

The ACH (Automated Clearing House) network in the U.S. and similar bank transfer systems in other regions, such as SEPA in Europe, enable direct bank-to-bank transfers. ACH is popular in B2B because it is low-cost, usually just a few cents or a small fee per transaction, and works well for regular payments like supplier invoices or payroll. Standard ACH transfers are not instant; they usually clear in 1 to 2 business days. However, they are faster than mailing checks.

Credit and Debit Cards

Credit and debit cards are common in B2B, especially for online purchases or paying vendors through a payment link. They provide convenience because buyers can pay their card bill later, and they are quick for sellers since authorization is instant. However, the fees for B2B credit card processing can be significant. Businesses usually use cards for specific types of payments, such as buying office supplies online, booking travel, or paying for SaaS subscriptions.

Cash

Cash is still used in some business to business payments, usually in local and small-scale transactions. For instance, a small business might pay a nearby vendor or delivery person in cash for convenience or if they don’t have electronic payment options set up. Cash allows for immediate settlement without processing fees, but it is impractical for larger amounts and longer distances. It also doesn’t create an automatic paper trail, which makes record-keeping more difficult.

Same-Day ACH (Wire Transfers)

For large or urgent payments, businesses often use wire transfers, which move money almost immediately through banking networks. Wires are common in cross-border B2B payments or high-value domestic transactions, though they come with higher fees. They are reliable for one-time large payments, like paying a foreign supplier, but less so for frequent small transactions because of the cost.

Virtual Cards

Virtual cards, which are single-use digital card numbers, are becoming a new way for B2B payments. A company can issue a virtual card to pay a supplier. This adds security and control because the number can be limited to a specific amount and expires after use. These methods still rely on card networks, but they meet business needs like better reporting and reducing fraud.

Digital Wallets

Some B2B transactions may use digital wallets, such as a business paying another business through PayPal, Apple Pay, or similar services. This practice is more common in e-commerce or when a small business accepts payments through consumer-style channels.

Cryptocurrency

Cryptocurrency is very niche in business to business payments but a few companies do accept crypto for B2B transactions or use stablecoins for cross-border payments to avoid banking fees.

Top Challenges in B2B Payment Processing (and Why They Still Exist)

Despite the ongoing improvements, B2B payment processing remains fraught with challenges for many companies. Here are some typical pain points and inefficiencies in the business to business payments space:

- Slow, Manual Processes: Businesses often say that B2B payments take a lot of time and effort. Let’s examine the traditional process:

- A paper invoice is received

- It’s entered into the system by hand

- Approval is requested from management

- A check is written or a bank transfer is started

- The supplier waits to receive and cash the payment

- This cycle can easily last more than a month

- Late Payments and Cash Flow Issues: In B2C sales, payment happens immediately. In contrast, B2B sellers deal with delays and the risk of not being paid. Many B2B invoices are paid after their due date, which disrupts cash flow and creates operational strain.

- High Processing Costs: There are hidden costs in managing B2B payments manually. Accounting and finance staff spend hours processing payments, reconciling accounts, and resolving errors. According to a survey, 43% of businesses said the high cost of using credit for business to business payments was a major concern. Additionally, 41% mentioned the overall high cost of making payments, including fees and labor, as a problem.

- Payment Errors and Disputes: Manual processes often lead to mistakes, such as a typo in an amount, a wrong account number, or a payment applied to the wrong invoice. Disputes about delivery status, pricing, or invoice accuracy delay payment settlements. Often, sales teams have to deal with payment problems instead of concentrating on revenue growth.

- Fraud and Security Risks: Fraud is a serious issue in B2B payments. Large payments attract criminals. Schemes like business email compromise, in which fake supplier emails request payment to fraudulent accounts, have cost companies billions. Recent data shows that check fraud attempts have doubled since 2021.

- Fragmented Systems and Lack of Integration: Many businesses use separate systems for invoicing, accounting, banking, and more that do not communicate with each other. As a result, teams transfer data between platforms by hand. This leads to duplicate entries and raises the risk of human errors.

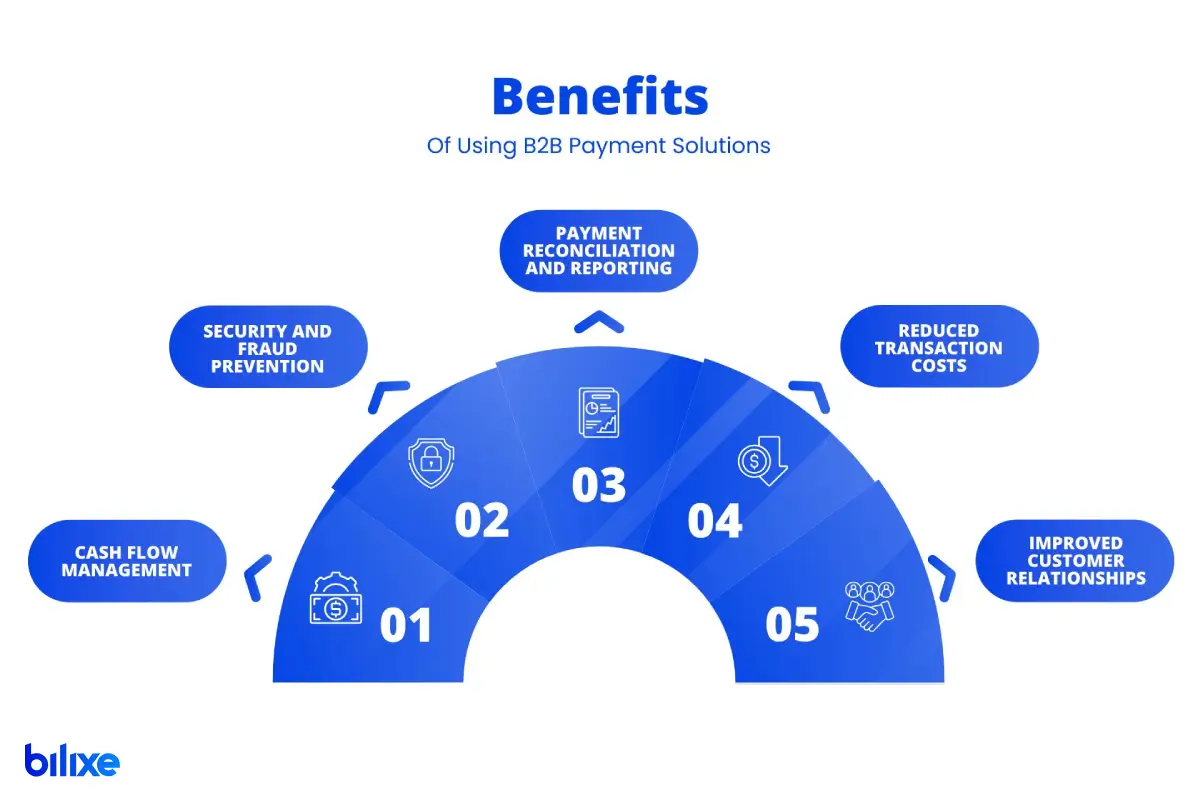

Benefits of Using B2B Payment Solutions

The use of specialized B2B payment solutions has the potential to greatly improve operational efficiency and financial management for businesses. Specialized B2B payment solutions may provide the following benefits:

- Cash Flow Management: B2B-focused payment solutions offer enhanced visibility into payments, invoicing, and accounts receivable. This is especially important considering dealing with larger transactions and longer payment terms typical for business scenarios. They also also offer automated scheduling and reminders, which enable businesses to avoid delays and more efficiently manage their cash flow.

- Better Security and Fraud Prevention: Specialized payment platforms integrate advanced security measures, such as multi-factor authentication, end-to-end encryption, and fraud detection solutions tailored to B2B payment processing.

- Payment Reconciliation and Reporting: Business to business payments often need clear reporting and precise reconciliation for transparency and compliance purposes. Specialized solutions offer customized reports and analytics and as a result make reconciliation easy.

- Reduced Transaction and Operational Costs: B2B payment solutions provide business-oriented pricing structures that lower the overall transaction fees compared to regular payment methods. Many of the B2B payment providers also offer custom-per-client pricing.

- Improved Customer Relationships: Faster, more reliable, and more transparent payment processing improves business relationships by building trust, efficiency, and satisfaction among the stakeholders.

List of Leading B2B Payment Gateways

Given the specific needs of B2B transactions, it’s important for companies to select payment providers that focus on B2B. Below is a B2B payment gateway list, that highlights popular payment service providers focusing on B2B payments.

💡 Tip

To understand the difference between a payment gateway and a payment processor, we recommend reading our article: ‘Payment Gateway vs. Payment Processor: What’s the Difference?‘.

A Smarter Way to Discover B2B Payment Solutions with Bilixe

To help businesses see clearly and find solutions ready for B2B, bilixe provides filters that highlight providers focused on business to business transactions. One useful feature it offers is a smart filter called “Industry Focus”.

This filter allows users to narrow down payment service providers based on the industries they serve. One of the options is “B2B”. Just open our directory and choose the B2B filter. This will allow you to quickly identify payment gateways and processors that focus on B2B payment processing instead of those that are more B2C-oriented.

FAQ: B2B Payments

Recommended Articles

Best Credit Card Processing for Small Business [Guide]

According to the Federal Reserve survey, about 80% of small businesses face payment-related challenges. That…

5 Steps To Low Payment Gateway Fees

You are probably paying more than you need to. A few percentage points may seem…

Best Payment Gateways In Indonesia: Top Picks Compared

Indonesia has one of the most dynamic payment markets in Asia, but it does not…

Find the Best Payment Service Provider for Your Business