Australia’s digital payments market is changing quickly. It’s important for merchants to know about local payment providers. Consumer behavior has shifted significantly toward cashless methods. According to the Reserve Bank of Australia (RBA), only about 13% of retail transactions were made in cash as of 2022. Cards, especially debit cards, and mobile wallets lead in in-person sales, with contactless “tap-and-go” payments accounting for over 95% of face-to-face card transactions.

Who This Guide Is For

This guide is intended for any business that accepts payments in Australia. This includes startups, small to medium businesses (SMBs), expanding scale-ups, and large enterprises. It’s written for local Australian merchants as well as international companies that want to sell to Australian customers.

What We Mean By “Australian Payment Providers”

“Australian payment providers” are companies that are either founded or based in Australia and help businesses accept payments. By focusing on local companies, we differentiate them from large global payment companies like Stripe, Adyen, PayPal that also operate in Australia.

Top Australian Payment Providers

Below, we highlight some of the leading Australian payment companies based on the types of businesses or use-cases they serve.

Best Overall PSPs For Most Businesses

This category includes flexible all-in-one PSPs that serve a wide variety of industries, such as retail, e-commerce, and services, as well as different sizes of merchants.

Best For Travel and Hospitality

These payment providers cater to the travel, tourism, and hospitality sectors. This includes businesses like airlines, hotels, booking agencies, and tourism operators.

Best For Subscriptions

Companies in software as a service (SaaS), membership services, utilities, and any business with recurring billing cycles need payment solutions that can securely store customer information and manage automated charges at set intervals.

Best For Non-Profit

These payment solutions are designed for non-profit organizations and charities in Australia.

Best For High Risk or Specialized Verticals

These providers serve high risk industries or specialized sectors such as adult entertainment, gaming, supplements, crypto, and more.

How Payments Work in Australia

To select the right payment service provider in Australia, it’s helpful to understand the local payment landscape – from consumer payment habits to the payment infrastructure and regulations.

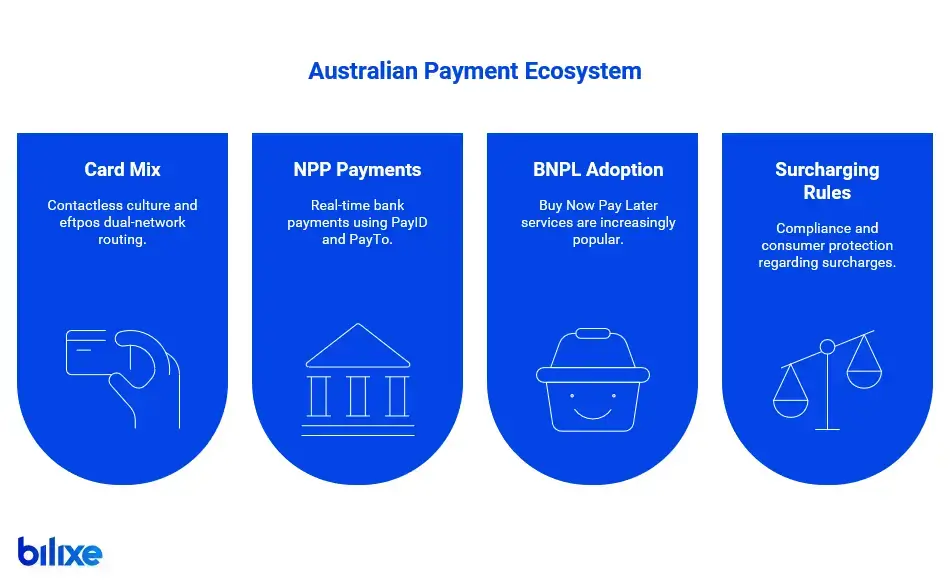

Card Mix, Contactless Culture, And Eftpos Dual-Network Routing

Australians are heavy card users, particularly with debit cards. In the past decade, debit cards have surpassed credit cards in transaction share due to consumers preferring to use their own funds. In 2022, card payments were the main method across nearly all business types, making up over 80% of transactions in categories like supermarkets and transport.

This high card usage comes with a widespread contactless culture, as 95% of in-person card payments in Australia are now made by tapping a card or mobile device instead of inserting or swiping.

A unique aspect of Australia is the common use of dual-network debit cards. Most debit cards feature both an international scheme (Visa or Mastercard) and the domestic eftpos network. When customers tap their debit cards, the transaction can route through either network. Eftpos is the local card network that usually has lower transaction fees, especially for debit transactions. To take advantage of this, many Australian merchants utilize Least-Cost Routing (LCR) for contactless debit payments. LCR automatically sends the payment through the cheaper network (often eftpos) instead of the default Visa or Mastercard route.

NPP, PayID, and PayTo: Real-Time Bank Payments

In addition to cards, Australia has modernized bank payments through the New Payments Platform (NPP), a real-time payment infrastructure that launched in 2018. The NPP allows instant bank-to-bank transfers with detailed data, leading to new payment options for merchants:

- PayID: This is the NPP’s addressing system. Instead of using bank codes and account numbers for transfers, individuals and businesses can register a simple identifier, like an email, mobile number, or ABN. This PayID links to their account. PayID has gained wide acceptance, with over 18.5 million PayIDs registered in Australia, allowing many people to receive real-time payments easily.

- PayTo: Launched in mid-2022, PayTo is a modern alternative to direct debit. It enables merchants to start real-time payments from a customer’s bank account with the customer’s prior approval through a “PayTo agreement,” generally approved via their banking app. Notably, PayTo transactions do not incur card scheme fees, making them advantageous for merchants dealing with larger purchases.

- NPP Instant Transfers: Even without PayID or PayTo, the base NPP allows customers of participating banks to send money to one another almost instantly. While real-time bank transfers are not as common as card payments for e-commerce and point-of-sale, they are growing.

In summary, Australia’s real-time payments ecosystem (NPP/PayID/PayTo) complements the card system. When selecting a payment provider in Australia, consider whether they make it easy to accept PayID payments or support PayTo for recurring billing. These options can lower transaction costs and attract customers who prefer direct bank payments.

BNPL Adoption in Australia

Australia was the origin of leading Buy Now, Pay Later (BNPL) services and remains one of the most engaged BNPL markets. A survey by Statista in 2024 showed that 43% of Australians have used a BNPL service in the past six months. For merchants, BNPL can boost sales; research indicates that adding BNPL options at checkout can raise average order values by 20-40% and increase conversion rates since customers are more inclined to complete purchases when they can pay in installments.

In Australia, small merchants who offered BNPL observed clear benefits. 84% of them reported revenue growth, with BNPL contributing about AUD 3.3 billion in net benefits to small businesses in 2024.

Surcharging Rules, Compliance, and Consumer Protection

Australia allows surcharges (extra fees charged at checkout for certain payment methods), but these are strictly regulated to be merchant-friendly. Businesses can surcharge card payments only up to the actual cost of acceptance for that card type. This means you can pass on your processing fee to customers, but you cannot charge more than your actual transaction costs.

The Reserve Bank of Australia (RBA) specifies which cost components can be included (typically merchant service fees, scheme fees, etc.), and the Australian Competition & Consumer Commission (ACCC) oversees the enforcement of limits on excessive surcharges. Merchants must demonstrate how their surcharge relates to their costs. The ACCC can investigate and penalize businesses that do not comply.

Good Australian payment providers will keep you informed about changes in regulations, such as new surcharging standards or least-cost routing enablement, so you can adjust your pricing strategy as needed.

Alternatives: Global Payment Service Providers in Australia

When To Pick a Global vs Local Provider

How To Find International Payment Service Providers Serving Australia

If you want to look into global payment companies in Australia, a useful approach is to use bilixe. You can visit bilixe’s listings page, and filter by “Supported Countries” to “Australia”.

This will provide you with a full list of payment processing companies, including global firms, that work with Australian merchants. You can then compare their features, fees, supported methods, and user reviews. This is more efficient than searching through results or individual websites.

Conclusion

This guide has provided a structured overview of top Australian payment companies across different categories and discussed the current market context of consumer habits and regulations that affect provider suitability.

Keep in mind that the “best” payment provider is not one-size-fits-all. The right provider aligns with your transaction patterns and growth goals. Bilixe helps you filter and find both Australian and global payment processing companies that meet your needs. By taking a thoughtful approach, you can confidently select a payment provider that serves your Australian customers effectively and grows with your business.

FAQ: Australian Payment Providers

Recommended Articles

International Payment Gateway List

What Is a Payment Gateway? A secure bridge between your business and the banks that…

Payment Gateway vs Payment Processor: What’s the Difference?

What Is a Payment Gateway? A payment gateway is a technology that enables merchants to…

High Risk Payment Gateway vs. Standard Gateway: Comparison Guide

Merchants exploring payment solutions often ask: Do I need a high risk payment gateway or…

Find the Best Payment Service Provider for Your Business