- High Risk Industries Booming in Latin America

- Regional Nuances: Why LATAM Presents Unique Risks

- What Is a High Risk Payment Gateway in LATAM?

- Key Features of High Risk Payment Gateway Services LATAM

- High Risk Payment Gateway Integration LATAM: What to Expect

- Mastering the Regulatory Maze in Key LATAM Markets

- List of High Risk Payment Gateways in LATAM

- Conclusion

- FAQ: High Risk Payment Gateways in LATAM

Latin America’s e-commerce market is growing rapidly. In 2023, online sales in the region reached about US$509 billion, marking a 27% increase from the previous year. With more than 80% of Latin Americans shopping online, this digital commerce boom offers significant opportunities for businesses, even those in traditionally high risk sectors. If you’re evaluating high risk payment gateways in LATAM, this guide summarizes the landscape, the must‑have capabilities, and the compliance reality on the ground.

A typical payment setup won’t work for high risk merchants. These merchants require a specialized payment strategy and partners who understand the Latin American landscape. Throughout this guide, we’ll also highlight high risk payment gateway features LATAM merchants should prioritize and what high risk payment gateway integration in LATAM usually entails.

High Risk Industries Booming in Latin America

Several high risk sectors are thriving in LATAM’s expanding digital economy:

- Online Gambling (iGaming): The iGaming market in Latin America is growing due to regulatory changes and increasing consumer interest. The total online gambling market, which includes sports betting and casinos, is expected to reach around $6 billion by the end of 2025, with projections nearing $10 billion by 2028, reflecting an annual growth rate of about 18%. Brazil has passed a law to legalize sports betting, and the presence of over 100 million gamblers in the region highlights both opportunity and risk. This sector is subject to strict regulations and high chargeback rates, making it a classic high risk area.

- Forex and Online Trading: Retail forex trading and CFD platforms are growing rapidly in LATAM’s fintech landscape. Countries like Brazil, Mexico, Argentina, and Colombia have witnessed a surge in retail investors entering forex markets due to economic volatility and accessible trading apps. From 2020 to 2022, the volume of forex trading by LATAM retail investors increased by nearly 34%.

- Nutraceuticals & Supplements: Latin America is a large and expanding market for nutraceuticals and wellness products, valued at over $50 billion in 2024. Many sellers of supplements and CBD/hemp products are classified as high risk because of health claims and differing legal statuses across jurisdictions.

- Travel and Ticketing: Travel and tourism are critical to LATAM commerce. In recent years, travel services accounted for roughly one-quarter of the region’s e-commerce volume. Online travel agents, airlines, and ticket marketplaces are classic high risk merchants. They often sell ticket items well in advance, leading to a greater risk of cancellations and chargebacks.

- Subscription Services: Recurring billing models, from streaming platforms to subscription boxes and dating apps, are gaining popularity in LATAM’s digital market. However, subscription businesses inherently face a higher risk of chargebacks.

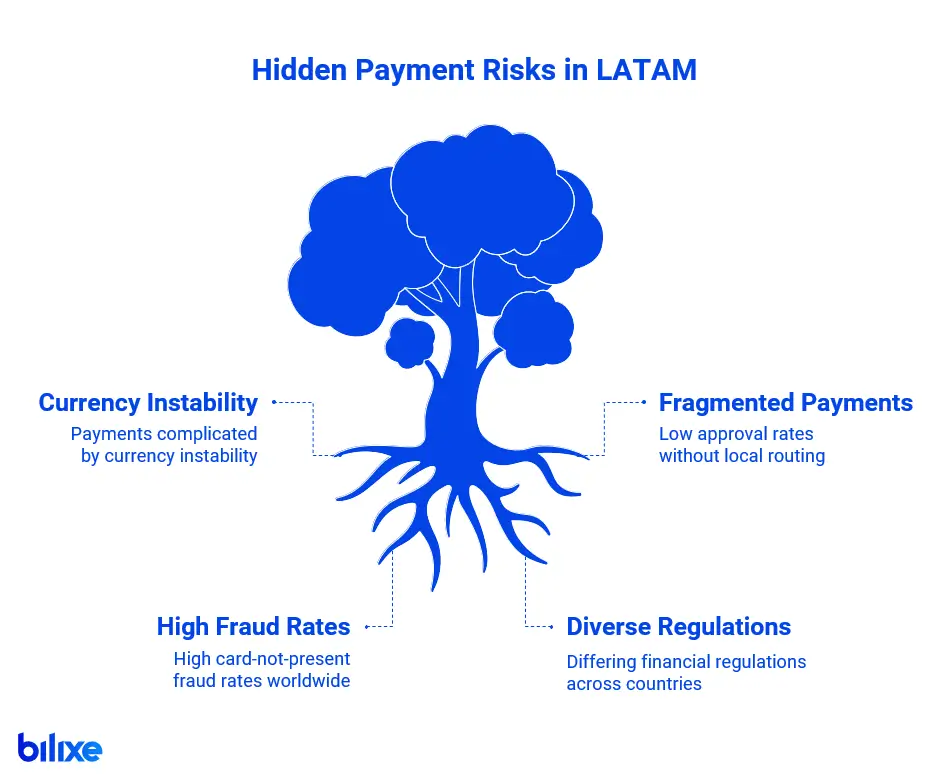

Regional Nuances: Why LATAM Presents Unique Risks

Running a high risk business in Latin America adds complexity beyond typical challenges. The region’s diversity means merchants must deal with unique risk factors:

- Currency Instability and FX Risk: Many LATAM economies have unstable currencies and strict exchange controls. Sudden devaluations or government-imposed restrictions can complicate routine payments. For example, Brazil’s real (BRL) often fluctuates, making financial planning difficult for companies dealing in local currency. Argentina has historically enforced tight capital controls that limit converting pesos to dollars, tying up funds for foreign businesses, though some of those restrictions have been eased since 2025.

- Fragmented Payment Ecosystem: Unlike Europe or the U.S., Latin America has a highly fragmented payments landscape defined by country, including preferences for payment methods and banking infrastructure. There are over 80 different payment gateways in LATAM, each connecting to various local banks and supporting different payment methods like credit cards, bank transfers, e-wallets, and cash vouchers. Transactions routed through foreign processors may only achieve a 20–45% approval rate, while transactions through local banks can see approval rates exceeding 80%. This gap means without local payment routing, businesses could lose more than half of their potential sales to unnecessary declines.

- High Fraud and Chargeback Rates: Latin America faces some of the highest card-not-present fraud rates worldwide. Merchants must contend with fraud rings testing stolen cards, identity theft, and friendly fraud at above-average levels. Roughly 20% of LATAM e-commerce transactions are flagged as fraudulent, which is double the global average, due to banks’ heightened caution. Fraudulent orders have reached up to 3.7% of all online orders, compared to the typical global range of about 1.5–2%.

- Diverse Regulatory Regimes: LATAM is not a single market but a collection of countries, each with its own financial regulations, consumer protection laws, and licensing requirements. What is permissible for a high risk business in one country may be restricted in another. For instance, Brazil requires that almost all transactions within its borders be conducted in the local currency (Brazilian Real – BRL).

Understanding these regional challenges allows high risk businesses to plan effectively. They can build payment setups with the flexibility and safeguards needed to thrive in LATAM’s dynamic and complex environment. In other words, succeeding with high risk payment gateways in LATAM means balancing performance, compliance, and localized risk controls.

What Is a High Risk Payment Gateway in LATAM?

A high risk payment gateway is a specialized online payment processing platform designed for merchants with elevated risk profiles. For more information, read our blog post “High Risk Payment Gateway vs. Standard Gateway: Comparison Guide”.

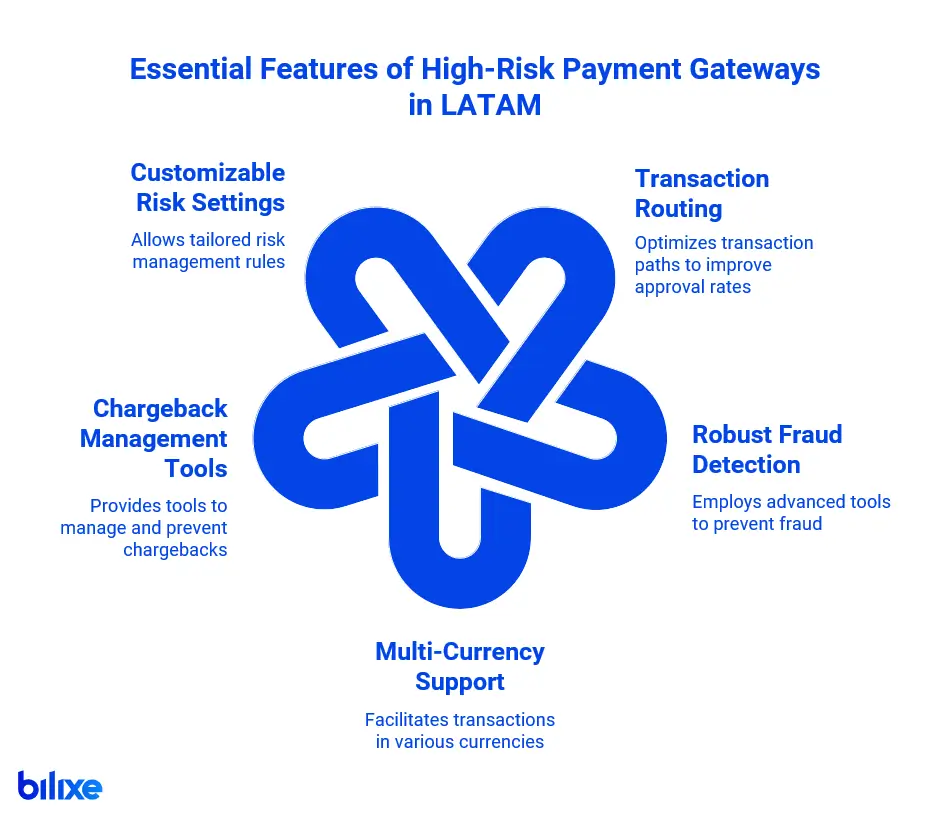

Key Features of High Risk Payment Gateway Services LATAM

When evaluating high risk payment gateway services in LATAM, look for the following capabilities that directly affect authorization rates, fraud exposure, and dispute outcomes. Must‑Have High Risk Payment Gateway Features LATAM:

- Intelligent Transaction Routing & Local Acquiring: To address LATAM’s high cross-border decline rates, high risk gateways utilize smart routing across a network of local acquiring banks. The aim is to process transactions domestically in each major market whenever possible. This approach significantly improves approval rates.

- Robust Fraud Detection and Security: Given the high level of fraud, the gateway should use advanced tools for fraud prevention. This includes real-time fraud scoring, blacklists/whitelists, velocity checks to detect card testing attacks, and support for 3-D Secure authentication on cards. Many high risk gateway providers highlight AI-driven fraud monitoring and chargeback prevention as vital components, and they are right to do so.

- Multi-Currency and Local Payment Support: LATAM has various currencies, including Brazilian Real (BRL), Mexican Peso (MXN), Colombian Peso (COP), Argentine Peso (ARS), and more, along with consumers who prefer to pay in US dollars for cross-border purchases. A high risk gateway should facilitate multi-currency processing, allowing you to price and settle in local currencies or USD as needed.

- Chargeback Management Tools: The chargeback ratio is critical for high risk businesses. A good gateway should offer tools for proactive chargeback management, including automated alerts to notify merchants of disputes in real time. This gives them a chance to refund or resolve issues before they escalate into formal chargebacks. High risk gateways typically allow slightly higher chargeback rates than low-risk ones before shutting accounts down.

- Customizable Risk Settings and Reporting: Each high risk business has unique challenges, so the gateway should allow for the customization of risk rules. You may adjust fraud filters, such as blocking transactions from certain countries or setting purchase amount limits, in the gateway’s dashboard. Real-time analytics on approval rates and chargeback trends can help you make timely adjustments to settings or business practices.

In summary, the features that high risk payment gateways services in LATAM offer focus on maximizing legitimate sales while reducing risk.

Related reading: “Best High Risk Payment Gateways in the USA [Guide]”.

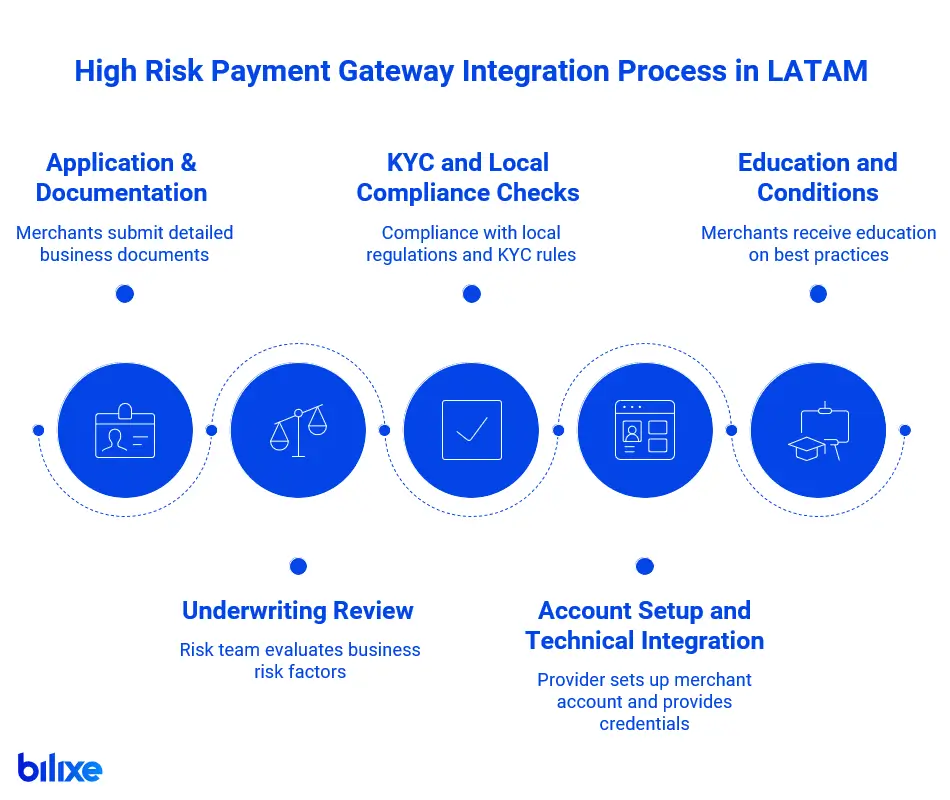

High Risk Payment Gateway Integration LATAM: What to Expect

Integrating a high risk payment gateway and securing processing approval is a more rigorous process than signing up for a standard PayPal or Stripe account. High risk merchants should expect a thorough underwriting and Know Your Customer (KYC) process from the start.

This section outlines what high risk payment gateway integration in LATAM typically involves.

- Application & Documentation: You’ll need to complete a detailed merchant application, providing more than just contact information. Expect to submit legal business documents like company registration and articles of incorporation, identification for business owners, financial statements or bank reference letters, and your processing history. If you have prior processing experience with chargeback ratios, that will be closely examined. You may also need specific local documents, such as a CNPJ number if you have a Brazilian entity or a local tax ID for invoicing.

- Underwriting Review: The provider’s risk team and acquiring bank partners will review all this information. They will evaluate your business’s risk level concerning chargebacks, fraud, and legal compliance. Factors like industry type, chargeback history, and countries served will influence their decision. High risk gateway underwriting typically takes several days or even weeks, significantly longer than low-risk merchants, where approval can be almost immediate.

- KYC and Local Compliance Checks: In LATAM, gateways will verify that you meet local KYC rules. If you plan to process payments in Colombia, for instance, you must operate under the appropriate license if one is required. If selling supplements in Brazil, you need Anvisa (health regulatory body) approvals if necessary. The gateway must also satisfy banks’ KYC requirements and verify the identities of business owners to prevent money laundering.

- Account Setup and Technical Integration: Once you receive preliminary approval, the provider will set up your merchant account(s) and provide integration credentials, such as API keys. Integrating high risk payment gateways in LATAM is technically similar to other gateways. You might use an API or a hosted payment page to link your website or app to the gateway.

- Education and Conditions: A good high risk provider will educate you on best practices. They might set conditions, such as a monthly processing volume cap initially or require a rolling reserve from day one. They will also emphasize the importance of keeping chargebacks under control.

Overall, be ready for a more comprehensive onboarding process compared to a standard payment gateway.

Mastering the Regulatory Maze in Key LATAM Markets

Compliance is essential for long-term success in Latin America, especially for high risk industries that face strict scrutiny from regulators.

Here’s a look at compliance challenges in major markets and why it’s important to choose a knowledgeable payment partner:

Brazil

As the largest market in LATAM, Brazil offers significant opportunities but also has strict local requirements. Brazilian law mandates the use of local currency (BRL) for domestic transactions, so foreign businesses must either partner with local payment facilitators or set up a local entity to process transactions in BRL. Additionally, Brazil’s tax authorities require capturing the CPF (individual taxpayer ID) for all online purchases to issue electronic fiscal receipts. This means any e-commerce checkout in Brazil must include a field for CPF, something that foreign payment gateways may not do automatically. A high risk gateway serving Brazil should manage CPF collection and tax receipt issuance automatically.

On the regulatory side, industries like iGaming were only recently legalized. As we mentioned previously, Brazil passed a law in late 2023 to regulate sports betting and is working on broader iGaming rules. Therefore, compliance for gambling or betting sites in Brazil requires obtaining the necessary licenses and following advertising rules.

Even in less regulated sectors, Brazil’s consumer protection code is strong. Chargeback disputes often favor consumers, and clear disclosure of installment interest is required. Working with a gateway that has a presence in Brazil or a Brazilian Central Bank license (as some payment facilitators do) can ease compliance challenges. They’ll understand how to handle the IOF tax on cross-border credit card transactions and the requirements of Brazil’s data protection law (LGPD) regarding customer data.

Mexico

Mexico is the second-largest economy in LATAM and has a relatively open digital market. There is no legal requirement to process through a local bank (unlike Brazil), but local payment methods are prevalent. Any payment strategy in Mexico must consider OXXO and SPEI (bank transfers) because many people are unbanked or prefer cash and pay-at-store options. From a compliance standpoint, if you’re in a regulated high risk area (such as forex trading or gambling), you’ll need to navigate Mexican laws.

Online gambling in Mexico is somewhat ambiguous. Technically only operators with a land-based permit can offer online betting via a “skin” under that permit. A payment gateway can’t magically make an unlicensed merchant compliant, but a good one will inform you of the requirements and may refuse to serve merchants without proper authorization to protect itself. Mexico also introduced a Fintech Law in 2018 that primarily impacts e-wallets and crypto exchanges. If you deal with e-money or crypto, ensure your payment provider understands these rules. Using a gateway that supports MXN currency and connects to Mexican acquirers will resolve many compliance and performance issues.

Colombia

Colombia has been a leader in regulating high risk industries, especially online gambling. According to law No. 1753 of 2015, since 2016, Colombia has required any online gambling or betting site to obtain a license from Coljuegos, making it the first in LATAM to do so. If you’re in this industry, compliance is critical; operating without a license can get you blocked and your payments halted.

One challenge is that Colombian banks are quite cautious. Many international transactions get declined if not processed locally. A strong LATAM gateway will likely have a Colombian acquiring partner or be integrated with the local credit card network (Credibanco/Redeban for Visa/Mastercard). They will also assist with tax issues, as Colombia has a VAT on digital services that foreign merchants might need to charge and report. A compliant payment provider can help by providing transaction records necessary for tax filings.

Argentina

Until recently, Argentina’s government had strict controls on foreign currency exchange, making it hard for revenue in Argentine pesos to be converted and sent out of the country. In April 2025, some of these controls were lifted, which could improve conditions for international merchants, but uncertainty still exists.

For compliance, if you’re processing payments locally in Argentina, you may need to use authorized channels (there are licensed payment aggregators in Argentina registered with the central bank). High risk sectors like forex or crypto are particularly challenging. Argentina has seen a crypto boom as a hedge against inflation, but there is no comprehensive regulation yet, so these activities operate in a gray area and face sudden policy changes.

Also notable is Argentina’s Consumer Defense Law, which is strict about refund rights and dispute resolution, contributing to a culture of chargebacks if customers feel wronged. Working with a payment provider in Argentina that can keep money flows above board (ensuring you use the official exchange rate where required, etc.) is vital.

Other Markets

Chile, Peru, and other countries each have their unique characteristics (for example, Chile has strong consumer protection laws and an open payment market; Peru just launched an instant payments system and has a developing regulatory environment). Taxation is another factor; many LATAM countries tax digital services or require local tax IDs to operate. A good payment gateway partner can guide you on whether you need to register for taxes locally or if they handle tax collection (some act as the Merchant of Record, simplifying this).

Compliance in LATAM is a challenge that varies by country. This is why partnering with a high risk payment gateway in LATAM that has local expertise and infrastructure in each target market is crucial.

List of High Risk Payment Gateways in LATAM

Choosing a high risk payment gateway in LATAM is a significant decision. The right partner can promote growth, while the wrong one can hinder your expansion or even jeopardize your business. We’ve prepared a list of high risk payment gateways in LATAM:

Conclusion

Latin America presents high risk businesses with a growth frontier that’s too important to overlook. By equipping yourself with knowledge (as you’ve done by reading this guide) and forming the right partnerships, you can turn the region’s complexities into an advantage. Remember to evaluate high risk payment gateway services in LATAM on their local acquiring coverage, fraud tooling, dispute workflows, and reporting depth.

FAQ: High Risk Payment Gateways in LATAM

Recommended Articles

How to Compare Online Payment Providers

Introduction Finding the right online payment provider is crucial for businesses of all sizes. Whether…

Best Credit Card Processing for Small Business: A Complete Guide

According to the Federal Reserve survey, about 80% of small businesses face payment-related challenges. That…

Payment Gateway vs Payment Processor: What’s the Difference?

What Is a Payment Gateway? A payment gateway is a technology that enables merchants to…

Find the Best Payment Service Provider for Your Business