High Risk Payment Gateways in LATAM: The Expert Guide

Latin America’s e-commerce market is growing rapidly. In 2023, online sales in the region reached…

Finding the right online payment provider is crucial for businesses of all sizes. Whether you are a startup launching your first online store, a mid-sized business expanding your e-commerce presence, or an enterprise managing complex global transactions, the choice of your payment gateway or processor can significantly impact your bottom line and customer experience. Yet, with hundreds of providers in the market, each offering varying fees, features, and regional coverage, making an informed decision can feel overwhelming.

Understanding how to effectively compare online payment providers is essential. Providers differ in their setup fees, transaction costs, supported payment methods, integration models, and compliance certifications, such as PCI DSS or PSD2. Additionally, certain providers may excel in serving specific industries, from high-risk merchant accounts to straightforward retail operations. Without a structured approach to comparison, businesses risk selecting payment solutions that either incur unnecessary costs or lack crucial functionalities needed for growth.

Traditionally, comparing payment solutions involved time-consuming research, navigating numerous provider websites, and requesting custom pricing information, often leading to incomplete or biased insights. Fortunately, modern comparison methods leverage comprehensive directories and advanced filtering tools, streamlining this once tedious process into something transparent and efficient.

This article will guide you step-by-step through the process of accurately comparing online payment gateways and processors by clearly defining the criteria most relevant to your business needs.

Choosing an online payment provider is far more significant than simply enabling transactions on your website. It directly influences your company’s profitability, scalability, user experience, and operational efficiency. Payment providers vary widely in their capabilities, pricing structures, and integration methods. By carefully comparing these elements, businesses ensure they select a provider that aligns seamlessly with their strategic goals, customer preferences, and budget constraints.

For a detailed perspective on how to navigate this decision, the article “How to Choose the Right Payment Service Provider for Your Business” offers a comprehensive guide. It outlines essential factors businesses should consider when evaluating payment providers, such as supported payment methods, pricing structures, compliance standards, fraud detection, integration options, and reporting capabilities. The article also highlights the importance of customer support and provider reputation, making it a valuable resource for companies looking to select a payment solution that aligns with both their current operations and long-term growth plans.

| Startups: Maximizing Value and Simplicity | SMBs: Balancing Cost and Growth | Enterprises: Ensuring Global Reach and Compliance |

| Startups often have tight budgets and limited resources, making cost efficiency and ease of integration especially critical. When startups compare online payment providers, their main focus tends to be on transparent fee structures and affordable transaction costs. Even small differences in per transaction fees can substantially affect profitability over time. Moreover, startups frequently look for simplicity in onboarding, clear API documentation, and minimal technical barriers to integration. | Small and mid sized businesses face a unique challenge of balancing cost efficiency with growth potential. They require providers who offer competitive pricing along with features that support their evolving business needs. These companies must carefully assess factors such as supported payment methods, industry specialization, and customer service responsiveness. | Enterprises operate within a more complex payment landscape. Global enterprises, especially those operating in multiple jurisdictions, must pay close attention to compliance certifications such as PCI DSS and PSD2. They must also consider geographic coverage and industry specific requirements to ensure broad acceptance and reliability. Robust integration options, detailed reporting capabilities, and automated merchant onboarding processes are essential for enterprises handling large transaction volumes and needing comprehensive oversight of their financial activities. |

Ultimately, no matter the size or industry of your business, systematically comparing online payment gateways and processors is essential. A meticulous comparison process provides clarity, helps mitigate risk, and ensures you select a payment provider that best supports your short term objectives and long term business success.

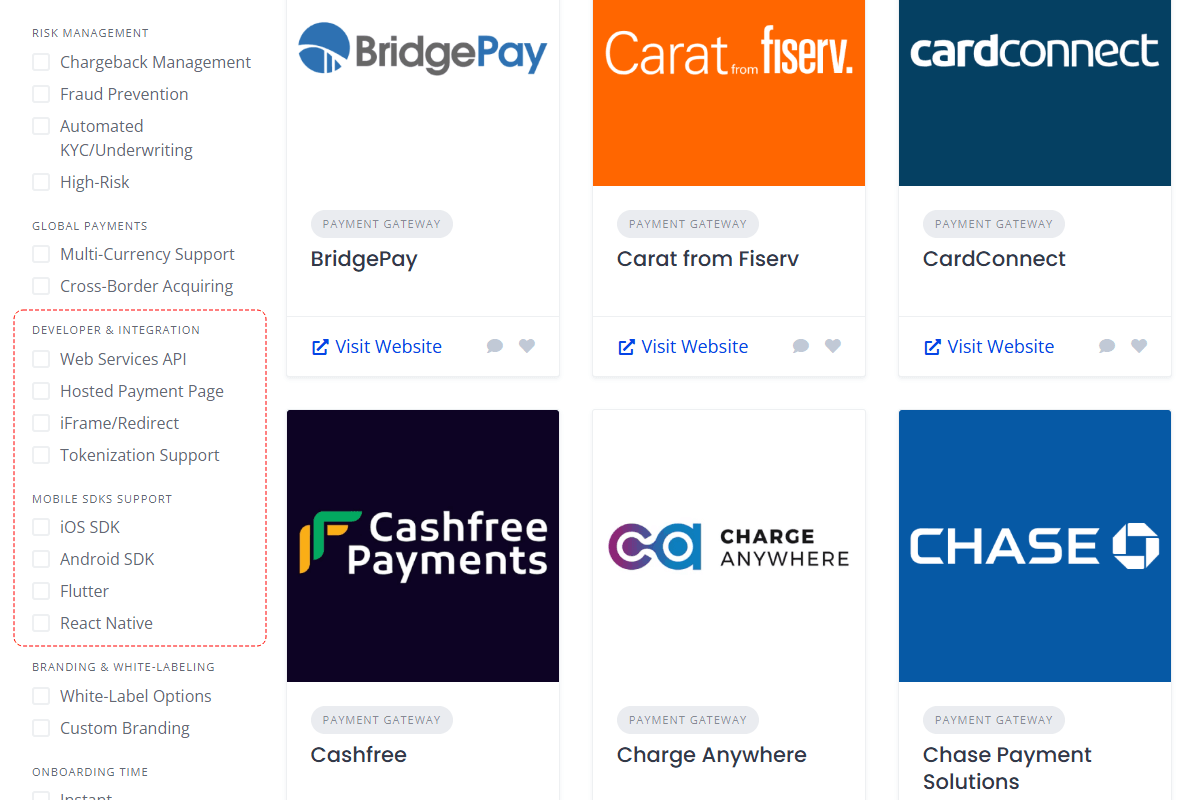

Selecting the right online payment provider requires systematically evaluating each solution against multiple important criteria. The following step by step guide explains how businesses can use smart filtering tools within bilixe’s directory to efficiently compare online payment providers and clearly identify those best suited to their needs.

The initial step in effectively comparing online payment providers involves applying general filters that reflect your business context. Start by identifying payment providers that meet your core requirements such as geographic service regions, targeted industries, or specific companies you might already be considering.

First, select the geographic regions your business operates in or intends to expand into. For instance, choosing regions such as Europe, Asia, or North America will immediately narrow down the list to providers that support transactions within these locations.

Next, refine results by industry type. By selecting your industry, such as eCommerce, gaming, hospitality, or financial services, you ensure providers that specialize in your particular sector are prioritized.

You can also use the search functionality to filter by specific company or product names if you have certain providers already in mind.

| Company | Name of the company (legal entity) that owns the proprietary payment getaway or payment processor |

| Company Size | The company’s size based on employee count and annual revenue. |

| Ownership | The company’s ownership structure. |

| Headquarter Country | The country where the payment company’s main corporate office or primary operations are based. |

| Supported Regions | Regions that are served by the payment service provider. |

| Supported Countries | Countries that are served by the payment service provider. |

| Industry Focus | Industries that are served by the payment service provider. |

| Target Merchant Size | The merchant’s size based on employee count and annual revenue. |

Pricing is often among the most decisive factors when choosing an online payment solution. Utilize pricing filters to quickly identify cost effective providers aligned with your financial expectations.

You can filter payment providers based on setup fees, monthly account maintenance costs, and per transaction fees. Reviewing this information side by side helps to clearly visualize and compare payment processing fees, simplifying the decision making process.

For a detailed view of the pricing structure, access links provided directly to the provider’s pricing page. This direct accessibility ensures transparency and accuracy without having to request additional quotes or details externally.

| Setup Fee (USD) | Setup account fee for the payment product |

| Monthly Fee (USD) | Monthly account fee for the payment product |

| Transaction Fee (USD/%) | Base-level pricing per transaction (or range) for the payment provider |

| Fee Structure | Fee structures offered by the payment service provider. |

| URL to Fee Schedule | URL to the dedicated webpage containing fee-related information (if available) |

Consider how your customers typically transact with your business. Transaction entry mode filters allow you to quickly find providers that support your payment acceptance methods.

If your business accepts payments in physical retail locations, filter for providers offering card present capabilities. If your business primarily operates online, filter by card not present payment options. Providers supporting mobile commerce or cryptocurrency transactions can also be selected accordingly to ensure compatibility with your business model.

| Transaction Types | Types of transactions the payment service provider supports. – Card Present – Card Not Present – POS Terminal – mCommerce – ACH/Bank Transfer – eCheck – Digital Wallets – Cryptocurrency – Instant Payouts – Recurring Billing – Buy Now, Pay Later |

Compliance filters help businesses identify payment providers that meet critical regulatory requirements. Applying filters for PCI DSS and PSD2 compliance quickly narrows the choices to providers that meet essential security and regulatory standards relevant to your business operations.

Choosing compliant providers ensures transactions remain secure, customer data is adequately protected, and regulatory risks are minimized, especially important when operating in tightly regulated markets or processing high transaction volumes.

| Compliance | Regulatory and security frameworks the payment service provider complies with: – PCI DSS – PSD2 – AML/KYC Screening – 3D Secure Support – GDPR – HIPAA – SOC 1 – SOC 2 |

| Risk Management | Risk management capabilities offered by the payment service provider: – Chargeback Management – Fraud Prevention – Automated KYC/Underwriting – High-Risk Merchant |

Evaluating integration capabilities is essential when comparing online payment gateways. Different integration models suit various technical capabilities and operational needs.

Filter providers by supported integration models such as Web Services APIs, hosted payment pages, or iFrame and redirect options. Businesses with advanced technical capabilities or specific customization needs may prefer API integrations. Meanwhile, smaller businesses or those seeking streamlined compliance might prefer hosted payment pages or redirect solutions.

| Developer & Integration | Integration options and developer tools supported by the payment service provider: – Web Services API – Hosted Payment Page – iFrame/Redirect – Tokenization Support |

| Mobile SDKs Support | Mobile software development kits (SDKs) supported by the payment service provider for app integration: – iOS SDK – Android SDK – Flutter – React Native |

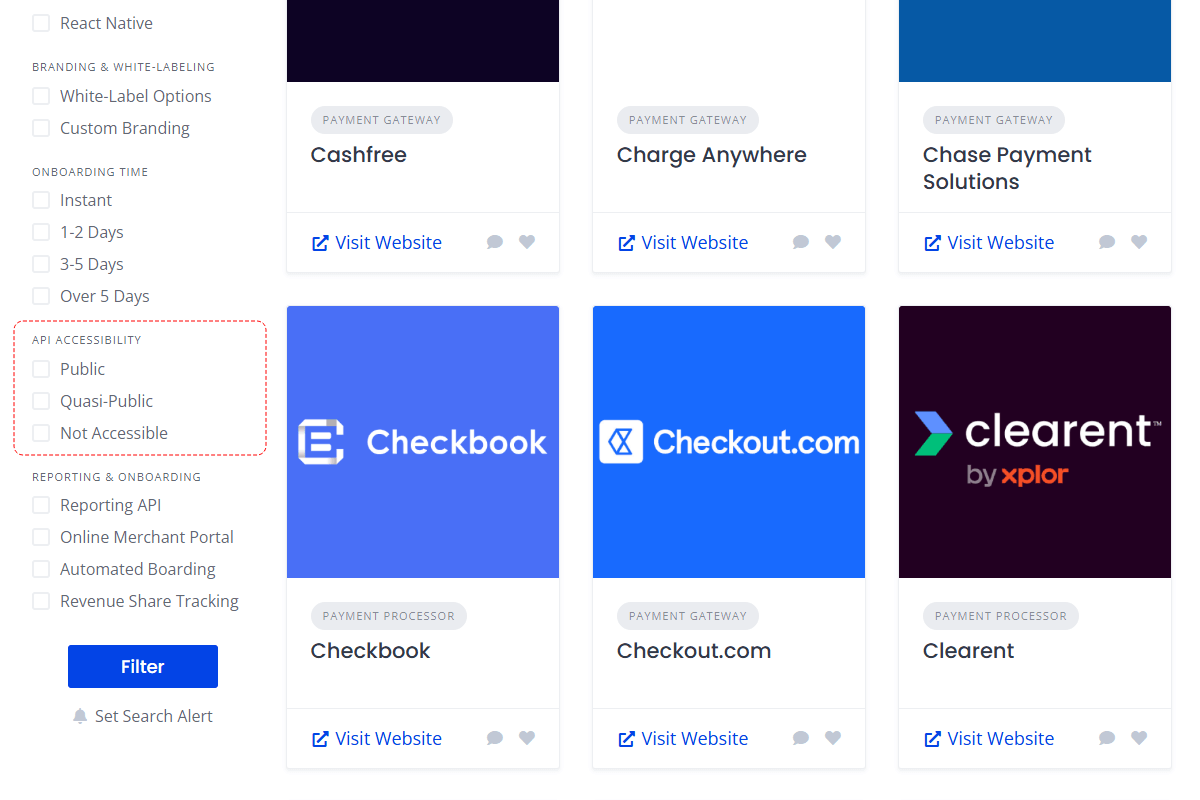

For businesses with strong technical teams or specific integration requirements, reviewing API details is critical. Filtering by API accessibility reveals providers whose APIs are publicly accessible, quasi public, or restricted.

| API Accessibility | API offered by the payment service provider: – Public API – Quasi-public API – Not accessible |

| API Docs URL | URL to the webpage containing the API documentation |

Lastly, consider filtering providers based on their reporting and boarding functionalities. Efficient reporting tools and streamlined onboarding processes can significantly impact operational efficiency.

Choose providers offering online reporting dashboards if you value real time visibility into transaction data and analytics. If integration into existing business intelligence or ERP systems is important, filtering for reporting API capabilities can be beneficial. Businesses seeking quick merchant account setup or operating platforms onboarding many sub merchants should filter by automated boarding capabilities.

| Reporting & Onboarding | Reporting tools and onboarding capabilities provided by the payment service provider: – Reporting API – Automated Boarding – Online Merchant Portal – Revenue Share Tracking |

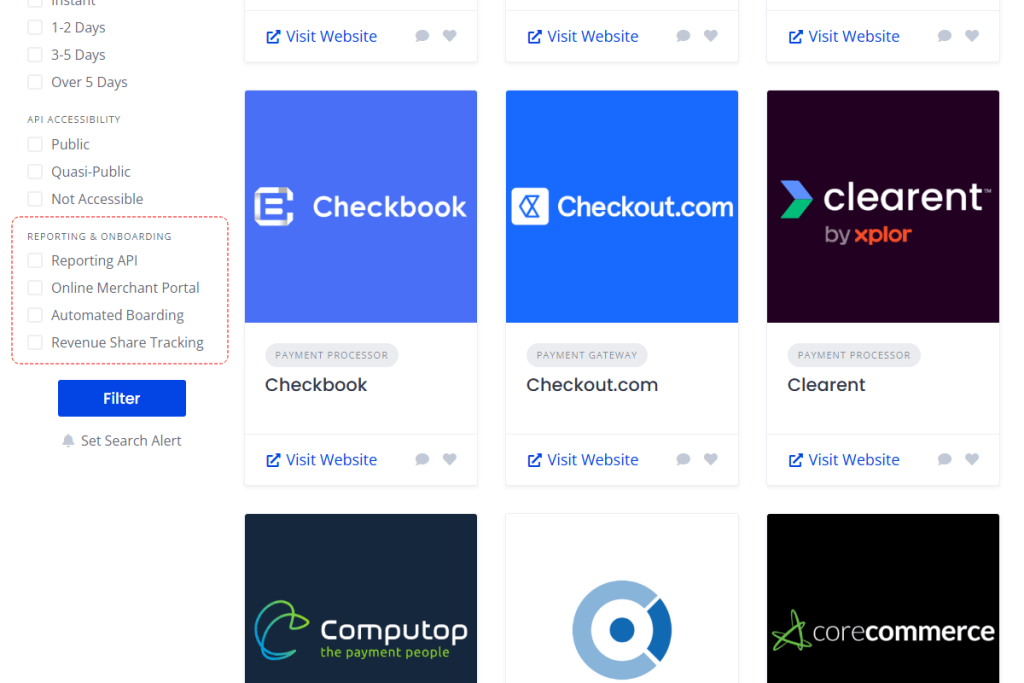

After applying relevant filters, carefully review the resulting list of payment providers. From here, examine detailed profiles, user reviews, and provider ratings to further refine your choices and ensure an informed decision aligned precisely with your business objectives.

This structured approach using bilixe’s filtering tools empowers businesses to thoroughly compare payment gateway charges, capabilities, and integration features, enabling confident selection of an optimal payment solution tailored specifically to their operational needs.

Once you have thoroughly narrowed down and compared online payment providers based on the essential criteria relevant to your business, the next step involves reviewing your filtered selections carefully to make an informed and confident final decision.

Begin by reviewing your shortlist in detail. Assess each payment provider individually, paying attention to their fees, compliance standards, supported transaction methods, and integration capabilities. Consider creating your own comparison chart to visualize side by side all the key criteria identified during your filtering process. This structured visualization simplifies the evaluation and highlights the comparative strengths and weaknesses of each provider.

Feedback from other businesses can provide valuable insights into the quality and reliability of a payment provider’s services. Review user ratings and comments to gain real world perspectives on customer service quality, ease of integration, transaction processing reliability, and overall user satisfaction. User experiences offer critical validation and may reveal important strengths or concerns that might influence your final selection.

If questions or uncertainties remain, consider directly contacting the shortlisted payment providers. Use available contact information to discuss specific needs, request clarifications, or negotiate customized pricing and terms. Engaging in direct communication allows you to validate information, gauge the provider’s responsiveness, and ensure that your business requirements are clearly understood and adequately met.

Whenever possible, request access to trial accounts or live demonstrations offered by the payment providers. Testing providers in a controlled or sandbox environment helps your technical team evaluate integration complexity, checkout processes, and back end reporting capabilities firsthand. This practical assessment often highlights potential technical issues, usability considerations, or hidden complexities that may impact your final choice.

Before committing to any payment provider, thoroughly examine contractual terms and conditions. Pay special attention to pricing structures, termination clauses, hidden fees, support service levels, and regulatory compliance commitments. Ensuring clarity around these contractual elements protects your business from unexpected costs, liabilities, or service limitations later on.

Once you have selected your preferred payment provider, establish a clear implementation plan outlining integration timelines, technical requirements, staff training, and compliance procedures. Clear internal communication and careful planning minimize potential disruptions during transition, ensuring seamless integration with your existing business operations.

Regularly review your payment provider’s performance against your expectations and business goals. Monitor transaction success rates, service reliability, compliance status, and customer support responsiveness. Periodically reassessing the provider ensures continued alignment with your business objectives and positions your company to quickly respond to changing market conditions or evolving business needs.

By carefully following these next steps, businesses of all sizes can confidently select an optimal payment solution that effectively supports their operational and strategic growth objectives.

Choosing the most suitable online payment provider significantly impacts your company’s operational efficiency, customer experience, and overall profitability. Given the complexity and sheer number of payment gateways, processors, and cryptocurrency payment solutions available today, making a careful, informed decision is essential. The ability to systematically compare online payment providers based on comprehensive, relevant criteria enables your business to thrive and maintain a competitive edge in a rapidly evolving digital landscape.

Careful, systematic comparison of online payment providers is therefore not simply a one time activity but an essential business practice that supports long term success and ongoing adaptability in the competitive digital economy.

Recommended Articles

Latin America’s e-commerce market is growing rapidly. In 2023, online sales in the region reached…

Digital payments have become a backbone of today’s economy – in 2024 the global volume…

Businesses today handle trillions of dollars in B2B transactions, but many are still using outdated…

Find the Best Payment Service Provider for Your Business